A quick update on Tuesday’s pathetic price action and what to expect next

By Jani Ziedins | End of Day Analysis

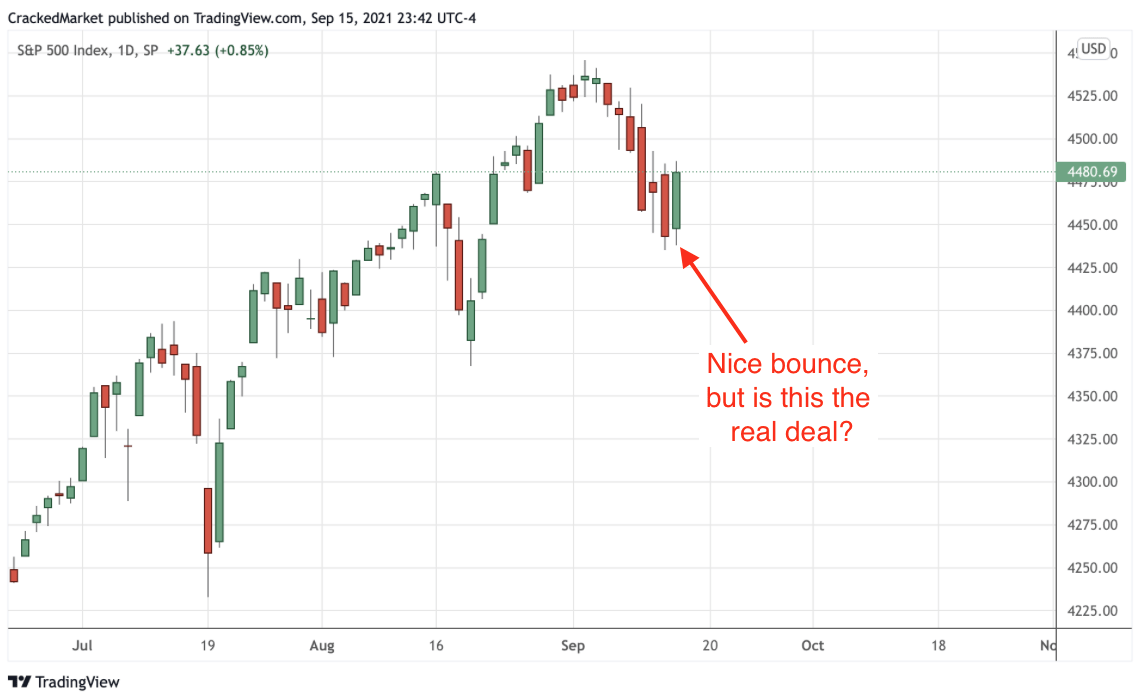

The S&P 500 started Tuesday well enough, opening in the green and extending Monday’s late bounce. But by the end of the session, the index gave back all of those early gains and finished flat.

While flat is clearly better than extending the selloff, it didn’t do anything to end the selloff. And unfortunately, that means the selloff is still alive and well.

As I wrote previously, this decline turned into an emotional selloff and we rarely shake those off within a few days. More often than not, it takes weeks and even months to get back to the old highs. To get these things through our system, most of the time we need to go “too far” before we can bottom and bounce for good. Tuesday’s weak rebound tells me we haven’t reached “too far” yet and we need to prepare ourselves for lower prices over the near term.

The only question is if we minorly violate Monday’s lows or if we smash through them and keep going. At this point, I could see either scenario playing out and that means our trading plan needs to be prepared for both.

Hopefully, everyone reading this blog has their trading account sitting in cash and is ready to pounce on these discounts. If the index falls under 4,300 over the next day or two, bouncing back above this level becomes an excellent entry point with a stop just under this level.

Remember, start small, get in early, keep a nearby stop, and only add to a trade that is working.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.