By

Jani Ziedins

|

End of Day Analysis

Free After-Hours Analysis:

Free After-Hours Analysis:

On Tuesday S&P500 closed flat after spending most of the day in the red. Prices dipped in anticipation of Trump’s announcement to leave the Iranian accord and reimpose sanctions. This injects further uncertainty into the already unstable Middle East. Not knowing what is going to happen next is a big reason oil has rallied above $70.

But as much noise as the media made over Trump’s widely anticipated announcement, the market largely brushed it off. Prices dipped more than 0.5% as the knee-jerk reaction was to sell the announcement, but anyone who has been paying attention knew the market expected this and it wasn’t a big deal. After the headline sellers finished selling, prices rebounded and I doubt many people will give this a second thought on Wednesday.

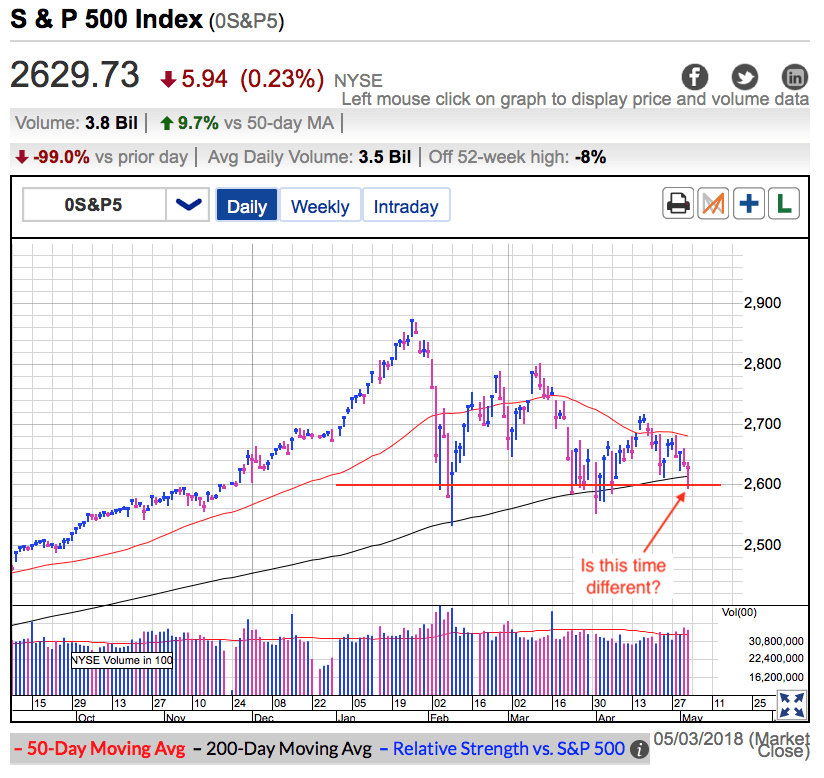

Last week it felt like the market was on the verge of collapsing. We undercut the 200dma and 2,600 support, but instead of triggering a wave of selling, that was the capitulation bottom and prices have rebounded back to the upper end of the recent trading range.

The thing about markets like this is both bulls and bears are right. Wait a few days and the bull will be right when prices rebound. A few days after that the bear will be right when we stumble back to support. While both sides keep getting proven right, the painful irony is both sides are also bleeding money from poorly timing their trades.

Bulls buy the strength when it confirms their bullish bias. Unfortunately buying strength in a trading range is jumping in at the exact wrong time. Same goes for the bears who short weakness moments before prices rebound. The biggest challenge in the market isn’t knowing what is going to happen, but getting the timing right. Unfortunately most bulls and bears are getting crushed in this sideways market because they are making the right move at the wrong time.

Last Thursday I wrote the following in my free blog post, the same day the market scared the hell out of everyone by crashing through the 200dma and undercutting 2,600 support:

“As I’ve been saying since February, we are in a trading range. That means buying weakness and selling strength. Stick with what is working until something changes. Did something change today? Nope. That means today’s weakness was a buying opportunity, not a chance to bailout “before things get worse”. Maybe we slip a little further, but that’s not a big deal. Remember, risk is a function of height. The lower prices go, the less risky it is to buy. If this market wanted to crash, it would have happened months ago. There have been more than enough excuses to send prices tumbling. Instead, every time we slip to the lows, supply dries up and prices rebound. This is a resilient market, not a weak one. And the only people losing money are the ones overreacting to these gyrations.”

Read the full post if you want to learn how I came to that conclusion, but less than 24-hours later the market exploded higher. As I said before, predicting the market isn’t hard, the trick is getting the timing right. And often it takes more than good timing too. Many times the market tests our conviction and convinces us to abandon our well thought out trades moments before proving us right. I don’t mind losing money on a bad trade because that is the cost of doing business. But there are few things more frustrating than losing money on a winning trade. I wish there was an easy answer for this, but recognizing the difference between conviction (right) and stubbornness (wrong) is the art of trading and only comes from experience.

But that was last week’s trade. What most people want to know is what is coming next. Even though the market is approaching the upper end of the latest trading range, I actually think there is a little more upside left in this rebound. The market likes symmetry and last Thursday’s dip under support was fairly dramatic. We should expect the rebound to be similar and it doesn’t feel like we are at dramatic levels yet.

The resilience of this rebound was confirmed by Tuesday’s strength in the face of Trump’s headlines. The midday selloff could have easily spiraled out of control and sent us tumbling back to support if this market was weak. Instead of accelerating lower, supply dried up and we rebounded. Prices tumble from overbought levels easily and quickly. Resisting the temptation to selloff Tuesday afternoon tells us the market is solid, not fragile. At the very least I expect a retest April’s highs. That said, even though the near-term path of least resistance is still higher, this is a better place to be taking profits than adding new money. In trading ranges we buy weakness, not strength. Those with profits should start looking for an opportunity to lock them in.

Long gone is talk of a Tech Meltdown. Weeks ago I told readers people would be kicking themselves for not buying those discounts and it didn’t take long for those discounts to evaporate. For months people were begging for a dip in their favorite stocks. Yet when the dip finally happened, most people were too scared to buy. Of course if this were easy, everyone would be rich. The thing to remember is most people lose money in the stock market, so that means doing the opposite of most people. If most people are selling great stocks, that means we should be buying them.

There is a lot less near-term upside left in most FAANG stocks because they have returned to their highs. but this trade is still alive and kicking and that means sticking with it over the medium term.

If you found this post useful, return the favor by sharing it on Twitter, Reddit, and Facebook!

Jani

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, have analysis like this delivered to your inbox every day during market hours.

You must be logged in to post a comment.