Why this rebound still has room to run

By Jani Ziedins | End of Day Analysis

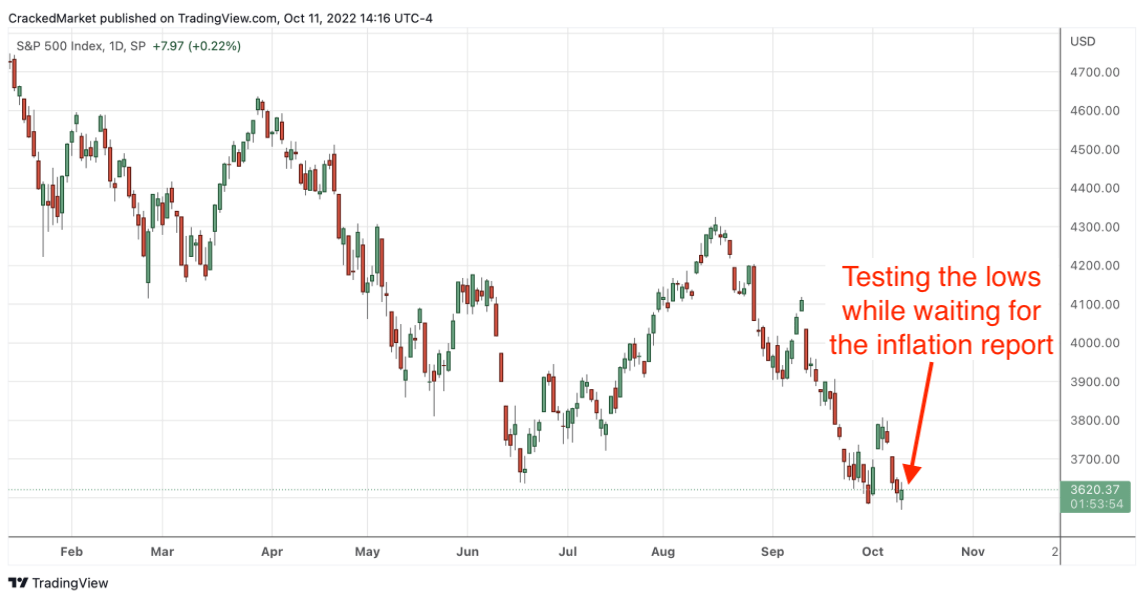

The S&P 500 finished Tuesday +1% higher, making this the third gain out of the last four sessions. And equally encouraging, the index is challenging the October highs, not bad for a market that was making multi-year lows only a few days ago.

Nothing much improved since last Thursday when September’s inflation report remained stubbornly high. But when bearishness is near historic levels, we don’t need good news to fuel a relief rally, simply being less bad than feared can be the spark that ignites a rebound from oversold levels. And let me tell you, Thursday’s bullish +5% intraday reversal was one hell of a spark.

Lucky for readers of this blog, we knew something big was coming even if we couldn’t be confident in the direction. As I wrote last Tuesday:

A big trade is around the corner, we just need to be patient and wait for it to come to us. Don’t let these meaningless, near-term gyrations throw you off. But once it gets here, don’t be afraid to grab hold because there will be lots of easy and fast profits to be had.

Everyone knows markets move in waves and it’s been a long and mostly one-way fall from the September highs, so even bears should have been prepared for a fast and hard bounce. Too bad greed and hubris cloud a person’s judgment.

Anyone can point out what’s obvious after it happened, but what readers really want to know is what comes next. Easy, there is no reason to assume the buying is anywhere near close to being done. The market loves symmetry and it’s been a dramatic and oversized fall from the September highs, so it is only reasonable to expect a similarly dramatic and meaningful rebound.

Now, don’t get me wrong, I’m not claiming symmetry means are headed back to the September highs, just that we should expect an equally dramatic and meaningful rebound to recover from these oversold levels. And it will take a lot more than three days of buying to balance out two months of nearly non-stop selling.

And this should go without saying, but markets don’t move in straight lines and this remains a volatile market, meaning we should expect lots of back and forth. But over the next few weeks, expect more up than down. In fact, a good bit more up than down. But don’t get complacent because those down days will be enough to make us doubt ourselves. We don’t need to look any further than Friday to see how strong the second-guessing can be. But as I said earlier, we are still in the early days of this rebound.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.