Why smart money is buying this bounce

By Jani Ziedins | End of Day Analysis

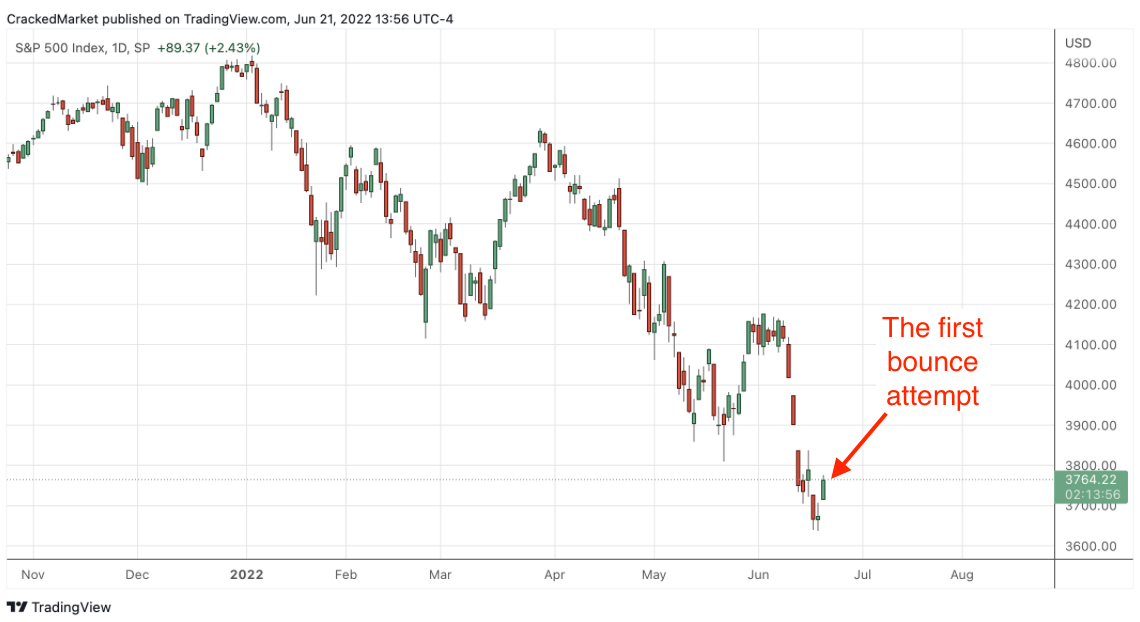

The S&P 500 came back from the three-day weekend well-rested and promptly popped 2.5% Tuesday.

Headlines haven’t improved in a meaningful way, but more importantly, they haven’t gotten worse either. Last week’s tumble to fresh lows seems to have reached a near-term capitulation as it ran out of fearful sellers, giving us this nice little bounce.

I’m under no delusion and think lower prices are still ahead over the medium and longer-term. But at the same time, I recognize markets move in waves and I also know bear markets have some of the biggest bounces on their way lower.

As bad as things felt last week, the selling got a bit ahead of itself and a near-term bounce seems appropriate. How long this lasts and how far it goes is anyone’s guess, but 4k resistance is very much on the table if we string together a few more nice up days. (A bounce back to 4k from Friday’s close represents a 9% gain in the index. Catch part of that wave in a 3x ETF and now we’re talking about real money!)

Buy the bounces and sell the breakdowns. Seems easy enough but we must have the courage to actually do it.

Now that the market is bouncing, it is time to close our shorts and start buying the bounce. Start small, get in early, keep a nearby stop, and only add to a trade that’s working. Follow those simple rules and there is money to be made. Or at least, it opens the door to a very attractive, low-risk trade.

Maybe we need to bounce a few times before making our way back up to 4k, but unless someone is psychic, we won’t know which bounce is the real bounce until after it happens. And since I’m not psychic, the best I can do is treat all of the bounces as if they are the real deal until they prove me wrong. But as long as I start small, get in early, and keep nearby stops, any mistakes will be fairly inconsequential, especially when compared to the profits that come from riding the next wave higher.

Trading is a game of risk versus reward and right now the risk/reward is stacked in our favor. Buy the bounce, move our stops up to our entry points as this rebound progresses, and if we get stopped out, no big deal, we step aside and wait for the next bounce.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.