Did something change Friday? It sure feels like it

By Jani Ziedins | End of Day Analysis

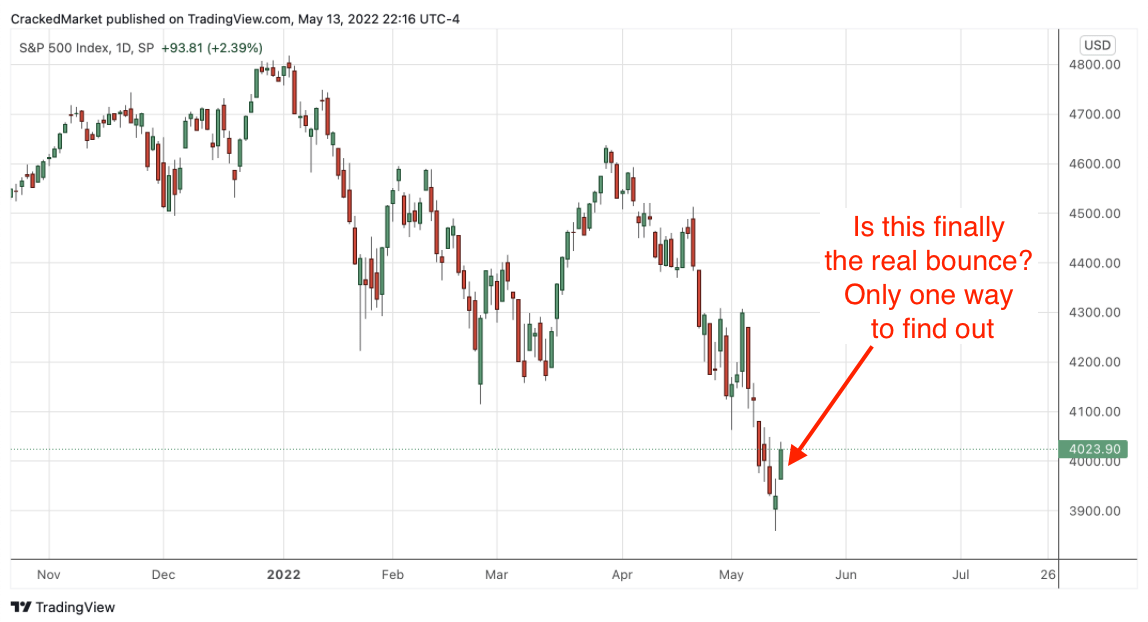

The S&P 500 finished Friday up 2.4%, the first meaningful gain in nearly two weeks and the first strong Friday close since March’s big rebound.

There were not any meaningful headlines driving Friday’s strength and instead, this is simply a routine bounce from oversold levels. Without any real meat behind this move, it could fizzle like all of the other failed bounces over the last several weeks. But as we know, markets move in waves and a bigger bounce is inevitable even if lower prices are still ahead of us. After falling 700 points over the last few weeks, even bears should be willing to admit a near-term bounce is imminent (at least the sensible bears).

Is this the start of a bigger bounce? It definitely feels like something changed, most notably the willingness to buy stocks ahead of the weekend. Rather than fear the weekend and get defensive, investors were finally willing to buy ahead of it.

But as is always the case, only time will tell and Monday’s price action will give us big clues about the market’s mood. Unfortunately, anyone waiting for Monday’s confirmation will be a couple of hundred points late to the party.

This remains a volatile market. While the risk of large swings feels scary, in reality, it actually makes this easier (and safer) to trade. That’s because once these things get going, they tend keep going. As we’ve seen over the last few weeks, violate support and the selling accelerates. But the same also applies in the other direction, once a rebound gets going, expect it to keep going as a wave of dip-buyers start chasing prices higher.

As long as we are decisive and make our moves early, it is easy to stay on the right side of a volatile market. Especially one like this that makes most of its big moves during trading hours (as opposed to large opening gaps).

I have no idea if Friday’s bounce will stick around next week, but it is acting well enough to give it the benefit of doubt. I bought Thursday afternoon’s bounce, added more Friday, and lifted all of my stops up to my entry points. Sitting on a nice profit cushion, even if this fizzles next week, I will get out near my entry points, no harm no foul.

One of these bounces is going to work, the problem is it will only happen after most people have given up. That simply means we need to be more persistent than most.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.