Why Friday was a good day for the bulls

By Jani Ziedins | End of Day Analysis

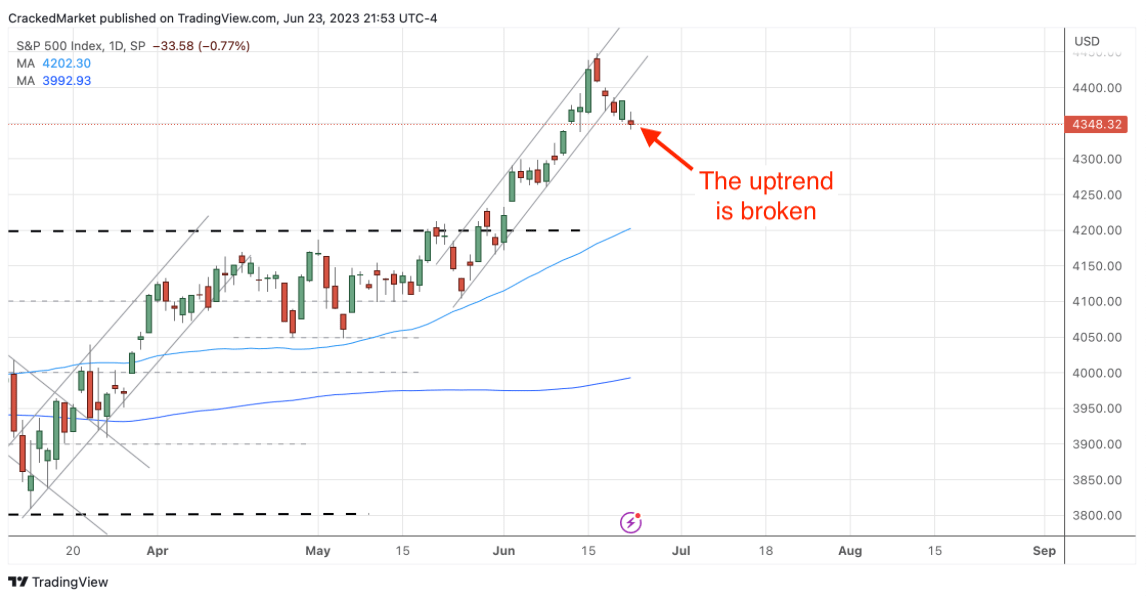

The S&P 500 ended Friday’s session exactly where it left off Thursday. While it is tempting to call 0.0% a tie, this actually counts as a win for the bulls.

First, following three big down days, not falling for a fourth session is a meaningful accomplishment. Big stock crashes accelerate lower, and Friday’s 0.0% breaks our losing streak.

Second, stocks started Friday’s session deep in the red. Lucky for us, that opening low was as bad as it got, and stocks spent the rest of the session climbing out of that hole, ultimately recovering all of those losses by the close.

Luckily, my readers were not surprised by Friday morning’s rebound. This is the exact setup I told readers to be ready for Thursday evening, and hopefully, you were one of the many people who profited from this great setup:

As bad as Thursday looked, the thing to remember is this is the way it usually feels right before the bounce. We can debate how bad it needs to get before this gets good, but without a doubt, we are closer to the bottom than we were on Tuesday or Wednesday.

The nice thing about one-way selloffs like Thursday is they tend to bounce early the next session. That means if we buy early enough, that initial bounce will give us a handy profit cushion to play with.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

Friday morning, confident stock owners refused to join the herd selling. That’s all it took. No matter how bad things feel, once we run out of sellers, prices stop falling. That’s basic supply and demand.

At this point, confident owners are telling the market that enough is enough. That doesn’t mean the selloff cannot continue next week or next month. But for the moment, the bulls are back in charge.

This bounce is only a few hours old and remains fragile, but this is the price action we were waiting for.

By acting decisively Friday morning, we already have a nice profit cushion and can move our stops up to our entry points, greatly reducing our risk. If this bounce is the real deal, the profits will keep rushing in. If this is another fake bottom on our way lower, we get dumped out near our entry points and get to try again next time, no harm, no foul.

As for next week, if the index retreats back to Friday’s intraday lows, all bets are off. But until that happens, we have the green light to keep holding, adding, and lifting our stops.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, help me out by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.