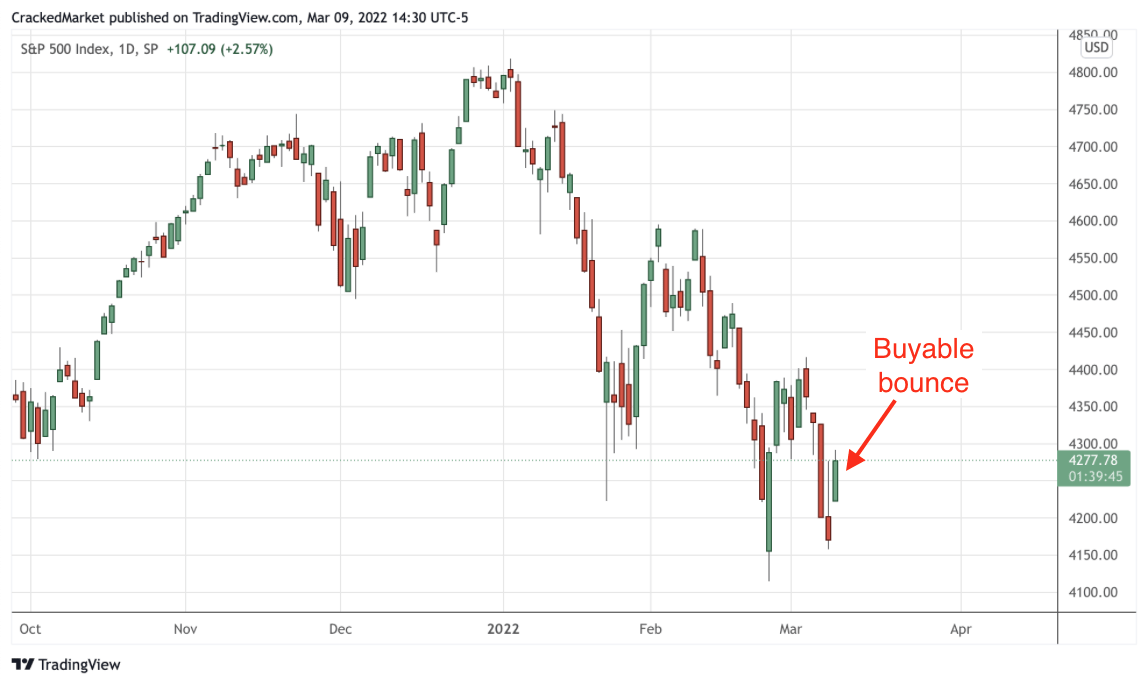

Is this finally the real bounce?

By Jani Ziedins | End of Day Analysis

The S&P 500 exploded 2.2% higher Wednesday after the Fed hiked interest rates for the first time since 2018 and laid out plans for another SIX hikes later this year…ouch!

That’s a bitter pill for investors addicted to cheap money, but the market was actually relieved the Fed’s plans weren’t even more aggressive and longer-term projections show rates topping out in a moderate 3% range.

Wednesday’s big gains add to Tuesday’s decisive rebound off of 4,200 support and that 4.4% two-day total is the biggest win in nearly two years. (Catch a ride on a 4.4% wave in a 3x ETF and now we’re talking about real money!)

So much for Monday’s bearish close under 4,200 support. But that’s the way this usually goes. Stocks only bounce after most people have given up. And unfortunately for all of Monday’s late sellers, not only do they have the humiliation of abandoning stocks at the lowest prices in over six months, they get to watch this rebound race higher without them. That’s the definition of adding insult to injury.

While I was equally discouraged by last week’s pathetic price-action and had low expectations Tuesday morning, I bought the bounce anyway because that’s what my trading plan told me to do. (Start small, get in early, keep a nearby stop, and only add to a position that’s working.)

Well, as is often the case, my gut was wrong while my trading plan was right. That’s a lesson I learned the hard way a long, long time ago and this single idea made more money for me than every other trick, tool, and strategy combined.

Come up with a simple, sensible trading plan and stick to it. Successful trading doesn’t need to be any more complicated than that.

As for what comes next, I’m fully invested and my trailing stops are above my entry points, meaning no matter what happens next, this is pretty much a free trade for me.

If prices continue higher, great, I let those profits pile up. If the selloff resumes and the index retreat under 4,200, I get out at my stops, collect some small profits, and get ready to try again next time.

If I’m right, I make a ton of money. If I’m wrong, I make a little bit of money. I love trades like this! But these opportunities only come to people willing to act early and decisively.

So to answer my opening question, is this the real bounce? Maybe. Maybe not. But no matter what happens next, this is a great trade for me.

Do you want to learn to trade like this? Sign up for my free email alerts so you don’t miss out.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.