The market answered our prayers, did you miss it?

By Jani Ziedins | End of Day Analysis

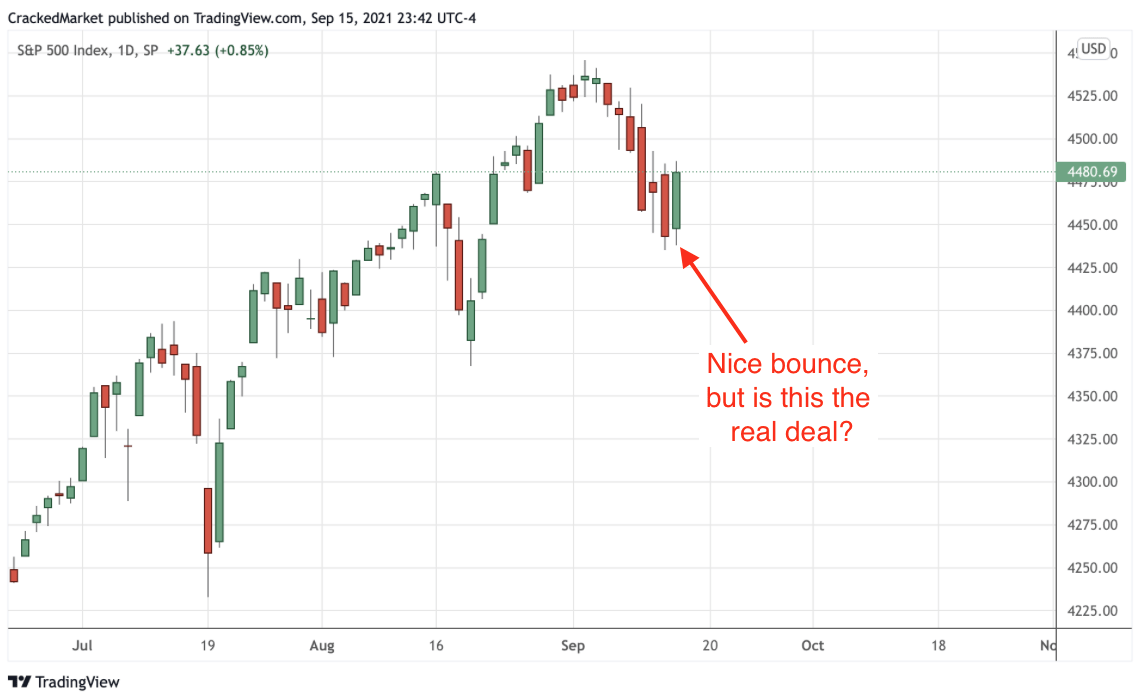

Meltdown, bounce back, meltdown, bounce back; the S&P 500 continues wrestling with what it wants to do next.

Following Monday’s meltdown, it felt like we were standing on a trapdoor, waiting for that next leg lower. Almost on cue, Tuesday bounced back, recovering nearly all of Monday’s losses. And so swings the pendulum of sentiment.

While it definitely feels like a bruising few weeks for bulls, they actually haven’t been doing too poorly since September 19th’s sharp down day. While the market probed and even violated those initial intraday lows, the selling keeps stalling and bounced not long after.

I could delve into all of the fundamental and technical reasons the market is doing what is it doing, but does it really matter? As speculators, all we want to know is how to trade this volatility. Lucky for readers I spelled it out Monday evening:

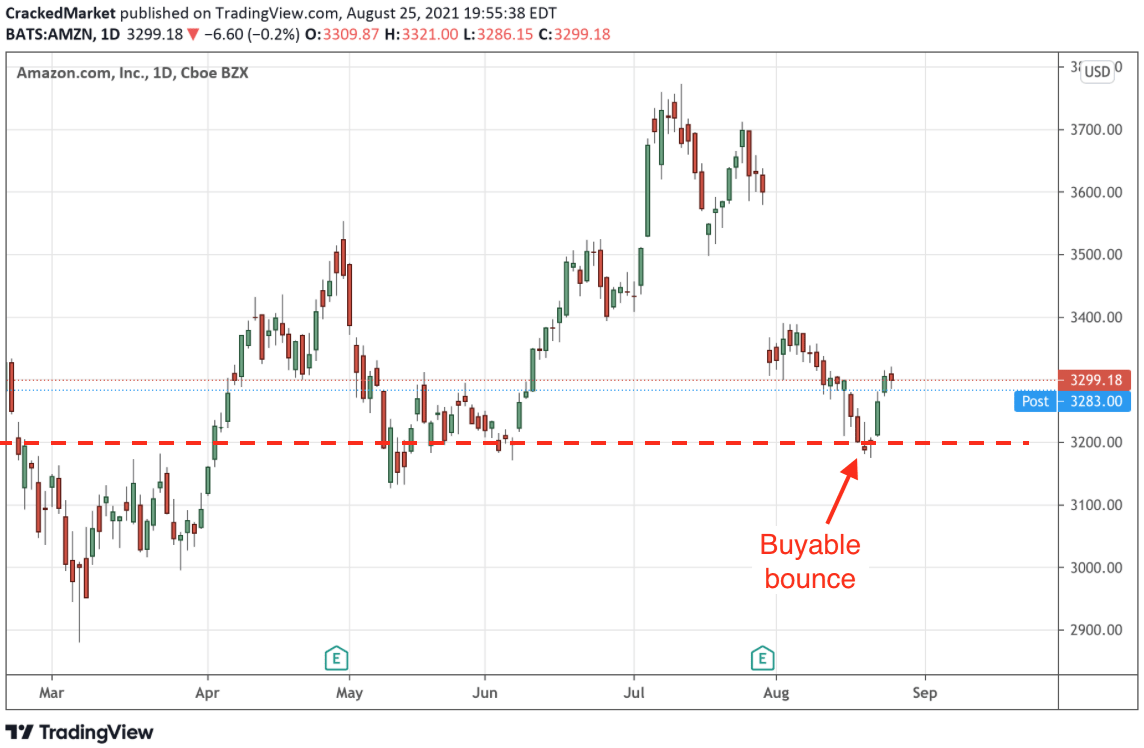

The simplest way of trading a volatile market is following its lead. If the selling continues Tuesday, we step aside and let it do its thing. If prices bounce Tuesday, we buy the bounce.

Guess what, Tuesday morning brought good news and the bounce is back on! For those of us that acted early, we got in at nice levels and were even able to lift our stops to our purchase price in the afternoon, more or less giving ourselves a free trade.

If this bounce keeps going, great, I collect all of those profits. If the bounce fizzles and retreats again, no big deal, I get out near my entry point and try again next time.

People beg for low-risk, high-reward trades. Well, guess what, the market just answered our prayers. Did you jump on the opportunity?

Now we wait to see what Wednesday brings….

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.