Why smart money is getting ready for the continuation higher

By Jani Ziedins | End of Day Analysis

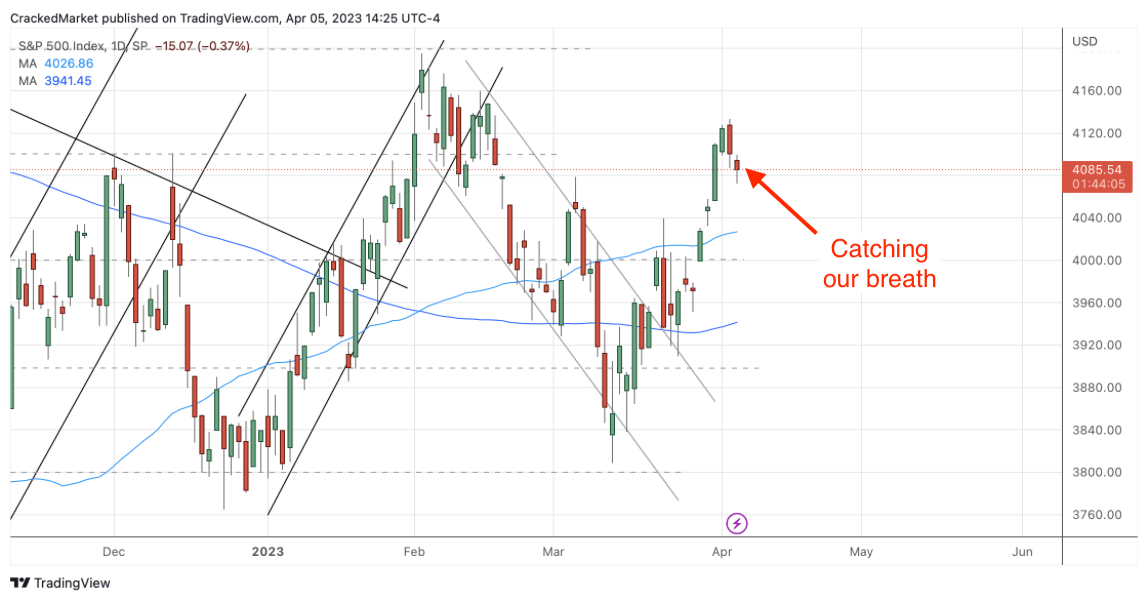

The S&P 500 wavered between modest losses and small gains through Monday’s sessions.

While sideways is not as much fun as up, the fact most owners ignored every dip over the last few weeks tells us a lot about the market’s mood. If this market was going to crack, it would have happened by now. Instead, most owners shrug and keep holding.

It was wise to get cautious and lock in worthwhile profits a couple of weeks ago when we first got to these levels, as I wrote back on April 3rd:

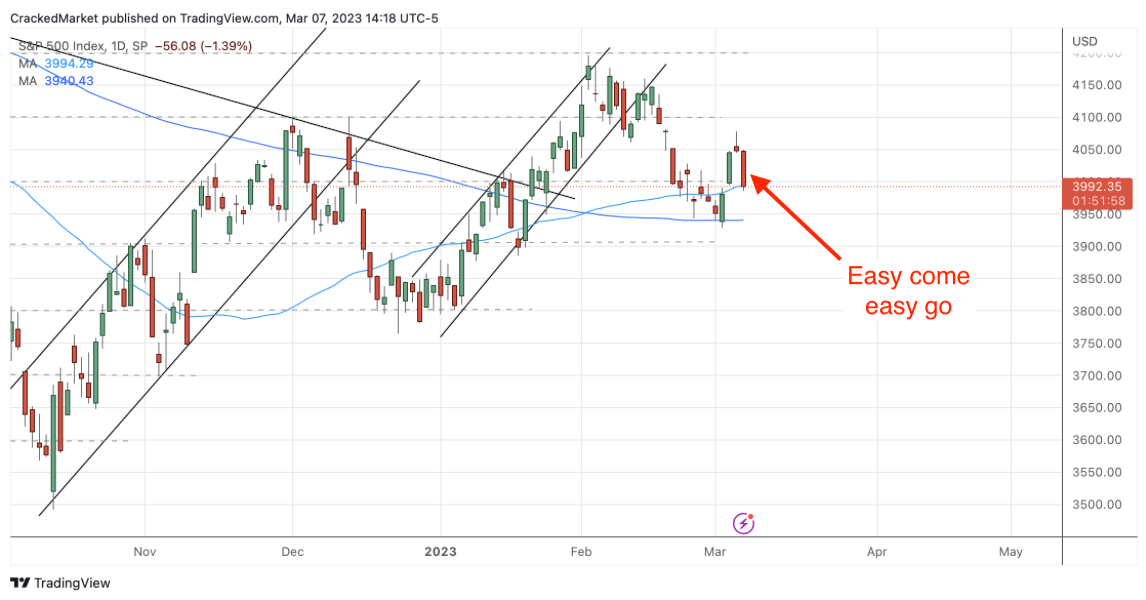

Stocks move in waves; they always have and always will. After a nice run like that, rather than pat myself on the back for profiting from March’s reversal, I’m getting nervous that too much of a good thing can end poorly for anyone that holds too long.

Don’t get me wrong, I’m not calling this a top. Momentum is far more likely to continue than it is to reverse, but with 300 points of upside in our rearview mirror, this is the wrong time to be getting greedy. Savvy traders are taking worthwhile profits and getting ready for the next opportunity.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

But after the typical step-back failed to materialize, we have to start considering the next move will be “high getting even higher.”

As I’ve said countless times before, something that refuses to go down will eventually go up. At this point, this looks like up is only a matter of time. While it isn’t hard to figure out what the market is going to do next, the challenge is always getting the timing right. More often than not, the key isn’t what trade to make, but when to make it.

As I wrote last week, this sideways grind could start moving at any time and that means we need to be ready for it. While Bulls and bears love to place their bets ahead of time, I like waiting for the move to start first. A nice bounce Tuesday will be the green light to give this trade a shot.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, help me out by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.