Why I’m holding stocks ahead of the Fed’s rate-hike

By Jani Ziedins | End of Day Analysis

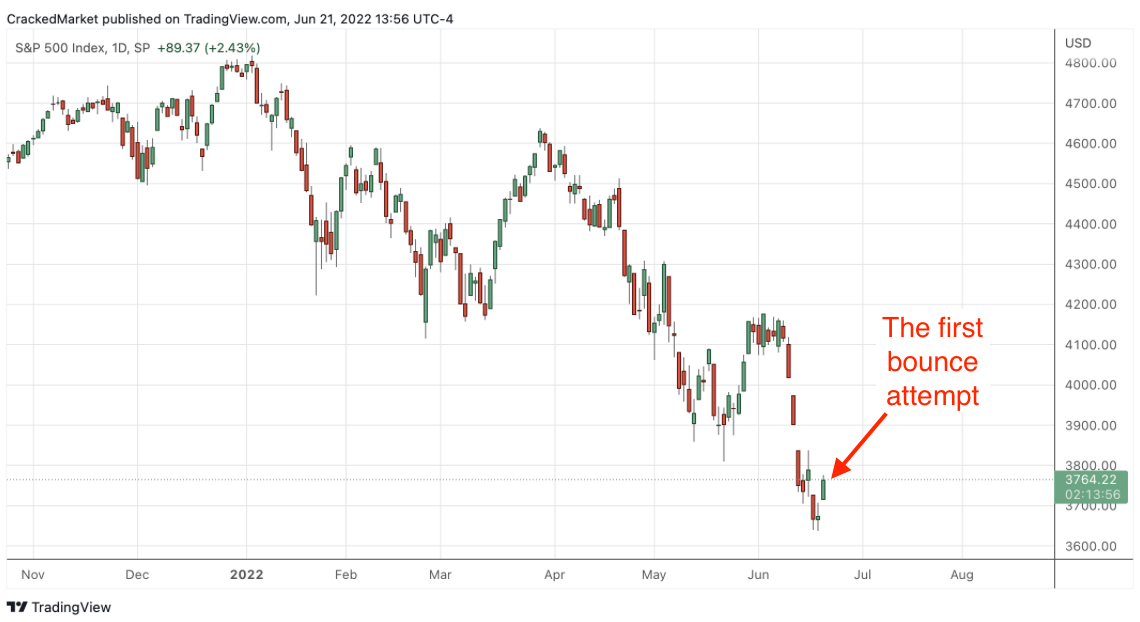

The S&P 500 slipped 1.1% Tuesday after it failed to hold Monday’s nice gains.

While it would have been more fun to watch stocks rally for a second day in a row, testing and bouncing off of recent lows isn’t a bad consolidation prize.

The first bounce in any attempted rebound rarely succeeds and Monday’s fizzled bounce fits that description. But encouragingly, even though the index undercut Monday’s lows on Tuesday, the selling stalled almost immediately. That tells us there isn’t a lot of extra supply sitting underneath the market. Instead, most owners seem content holding through a minor violation of recent lows. And when owners don’t reflexively sell, supply dries up and prices bounce, which is what we saw Tuesday afternoon.

Even though the index finished more than 1% in the negative, Tuesday was actually fairly constructive. As anyone that’s been doing this for a while can tell you, the first thing a downtrend needs to get turned around is to stop going down. And at least for the last couple of sessions, this market stopped going down.

No one knows for sure what the market will do Wednesday after the Fed announces the next rate hike and lays out its expectations for the next few months, but seeing prices 550 points under recent highs means a big portion of the near-term downside has already been realized.

As scary as buying feels right now, the market has been acting decently the last two sessions and these reduced prices mean the risks of buying here are equally reduced.

Now, I’ll be honest, I’m not excited to be buying this near-term stability, but that’s the way all of my best trades feel in the beginning. (It’s the easy trades that typically cause the biggest problems.)

As much as I think stocks will rally after the Fed’s statement turns out “less bad than feared”, if the waves of selling return, I’m more than happy to admit I’m wrong, pull the plug, and even go short again if the selling accelerates.

Long but standing next to the exits is the way I’m approaching Wednesday.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.