The warnings this week was shouting at us

By Jani Ziedins | Weekly Analysis

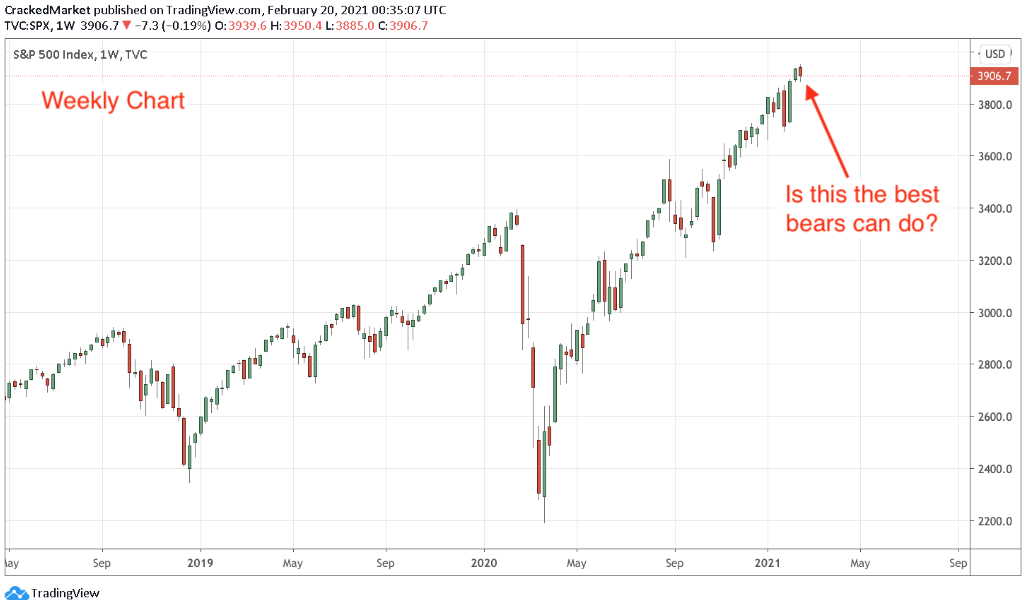

The S&P 500 finished the week 0.57% in the red, making this the first time we’ve had two consecutive down weeks since May.

The good news is that two week selloff back in May was nothing more than a minor hiccup on our way higher and the next three weeks finished green. Will we be as lucky this time? That’s the million-dollar question.

The most notable difference between this week and that episode in May is this week ended at the weekly lows while back in May, that second week finished near the weekly highs.

As I often write, it isn’t how we start but how we finish that matters most. And in this case, this Friday afternoon gave us a very poor finish.

The market attempted several bounces over the last two weeks and each one ended in disappointment. Markets bounce decisively from oversold levels and this week’s pathetic rebounds tell us we are not yet oversold. And if we know anything about emotional pullbacks, it’s that they don’t give up until they’ve gone too far. Quite simply, if this market isn’t oversold yet, then the selling isn’t over.

I still like this market even though I am approaching it with a lot more caution given the changing seasons. But I’m still treating this as a buyable dip. Friday’s violation of the weekly lows was a clear signal to get out. But that line in the sand now becomes our next buy signal. Bounce back above this level next week and it is time to get back in. Start small, get in early, keep a nearby stop, and only add to a trade that is working.

We will know pretty early in the week if this market wants to bounce or continue falling. Rather than try to predict what it will do, savvy traders simply wait and follow its lead.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.