Was Wednesday the calm before the next storm?

By Jani Ziedins | End of Day Analysis

Wednesday was a quiet session for the S&P 500 as the index finished almost exactly where it started. That was a welcome relief following Tuesday’s massive bearish reversal.

Does Wednesday’s stability suggest the worst is already behind us? I wish the market was that easy. Unfortunately, these things are rarely one-day events and that means the ugliness will likely continue Thursday and/or Friday.

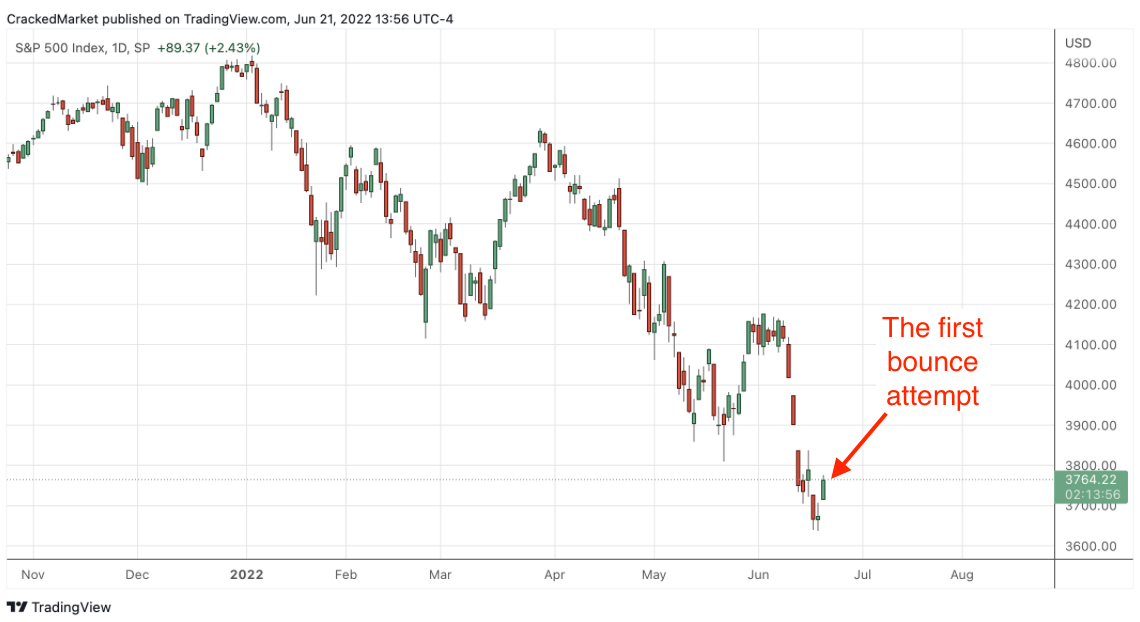

While last week’s 6.5% rebound was impressive and 4k seemed within reach, the further along we get into a selloff, the less energy these moves have.

Early in the correction, selloffs and rebounds crashed through support and resistance. But after a while, investors start getting used to our new reality and emotion starts coming out of the market. That’s when these swings start stalling and reversing before reaching key support and resistance levels.

Nearly six months into the 2022 bear market and it makes sense last week’s rebound stalled before reaching 4k resistance.

But if the rebound stalled under 4k, then that means we are already riding the next wave lower. Maybe prices slip to 3,700 and find support. Or maybe we need to retest the lows near 3,600. Either way, both of those down legs involve further declines from here.

Or maybe Tuesday really was a rare one-day event, we bounce off of 3,800 support, and finally get up to 4k resistance. While not the most likely outcome, it is still very much a possibility.

Lucky for us, we are nimble traders and don’t need to commit to anything. Buy the bounce off of 3,800 and short the breakdown under 3,800. No matter what the market does next, we will be ready for it.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.