A simple trade for next week

By Jani Ziedins | Weekly Analysis

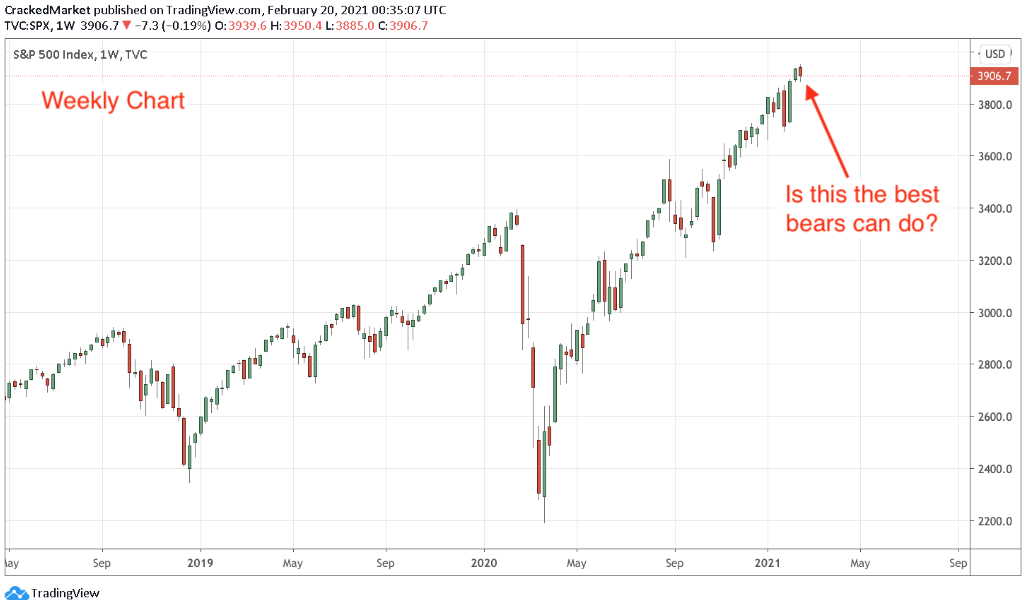

It’s been a rocky couple of weeks for the S&P 500. Rather than bounce back from last week’s string of down days, we added to them. This week’s 2.4% loss was the largest since the final week of January and the second-biggest since November’s election.

As bad as that sounds, these periodic pullbacks keep turning into bullish higher-lows. At this point, the index remains above a trendline stretching back to just after the Covid lows. This pullback needs to keep going if it is going to do any meaningful technical damage.

That said, everything could change next week if the selling resumes. But until that happens, this isn’t anything more than a routine and healthy step-back on our way higher. Two-steps forward, one-step back. Rinse and repeat.

This leaves the market at a key tipping point. If this dip is truly like every other step-back over the last several quarters, the bounce is just around the corner. Rebound back to the highs and nothing has changed. Extend the selloff and we are entering uncharted territory.

Investors have become fixated on rising 10-year Treasury yields. Is this finally the start of something new and we should be concerned? Maybe. But this bull market ignored a once-in-a-hundred-year global health pandemic, it shouldn’t surprise anyone if it shrugs off a jump in interest rates from 0.5% to the still absurdly low 1.5%.

Is the bull market dying? No, probably not. But we will learn a lot about the market’s intention next week when either the index bounces or it continues lower.

As for a trading strategy, it is pretty straightforward. The market is buyable above 3,800 and sellable under this level. It doesn’t get any more complicated than that.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.