Another good day for $SPX and a buy signal from $TSLA

By Jani Ziedins | End of Day Analysis

After spending most of Wednesday at record levels, the S&P 500 pulled back modestly at the end of the day and just missed a record close by a measly 2 points. Close, but no cigar.

While it is never helpful to see a stumble into the close following a push to fresh highs, the market deserves a pass this time. Wednesday was the final day of the first quarter and some institutional investors move things around for housekeeping and reporting purposes. This window dressing isn’t significant and doesn’t mean anything. I won’t give this late fizzle a second thought as long as the selling doesn’t continue Thursday.

At this point, the market is in good shape and passing through 4k seems inevitable, if for no other reason than the market tends to go where everyone is looking.

It’s taken the market nearly two months to go from 3,900 to 4k. That’s a very reasonable amount of time and cooled off some of our previous “overbought” conditions. Sometimes markets rest by pulling back, other times they rest by trading sideways.

This sideways consolidation hasn’t been long enough to support a dramatic rally, but we are on pace for a continued grind higher. As long as we keep getting more up than down, everything is going according to plan.

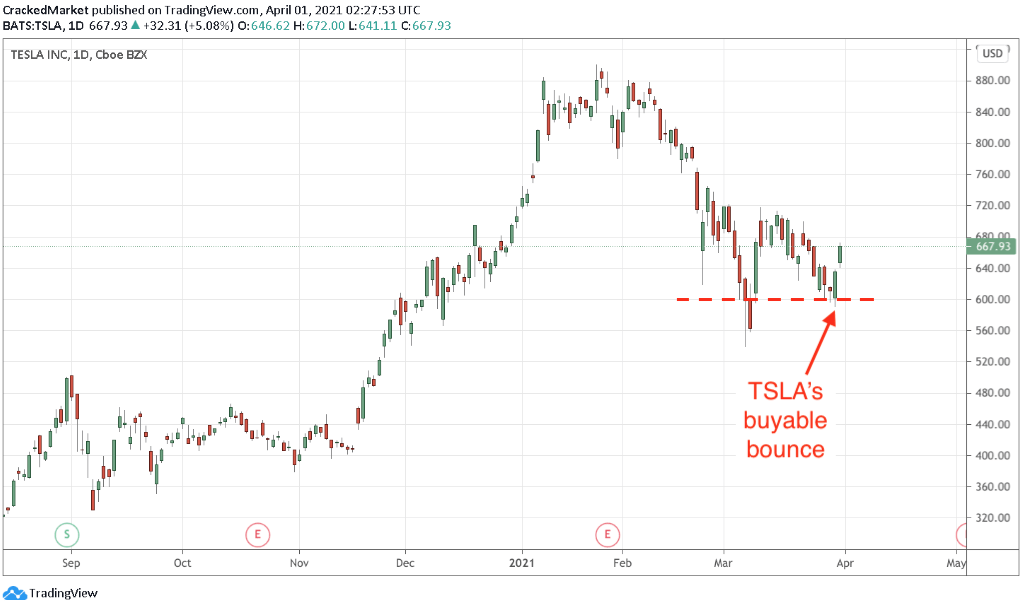

TSLA has done a really nice job bouncing off of $600 support. As I wrote on Friday:

If anyone was fortunate enough to be reading this blog back in February and locked in some nice profits near $800, this is a good place to be adding some of that money back. Place a stop under $600 and see where this bounce goes.

That said, be wary of any retreat back under $600, especially so quickly after bouncing off of support. If dip buyers don’t show up and this falls under $600 over the next few days or weeks, that shows demand is a problem and lower prices are ahead. And the scary thing is there is a lot of clear air between $600 and $400 support.

But that is simply a contingency. As long as TSLA remains above $600, all lights are green.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.