The worse this looks, the more I like it!

By Jani Ziedins | End of Day Analysis

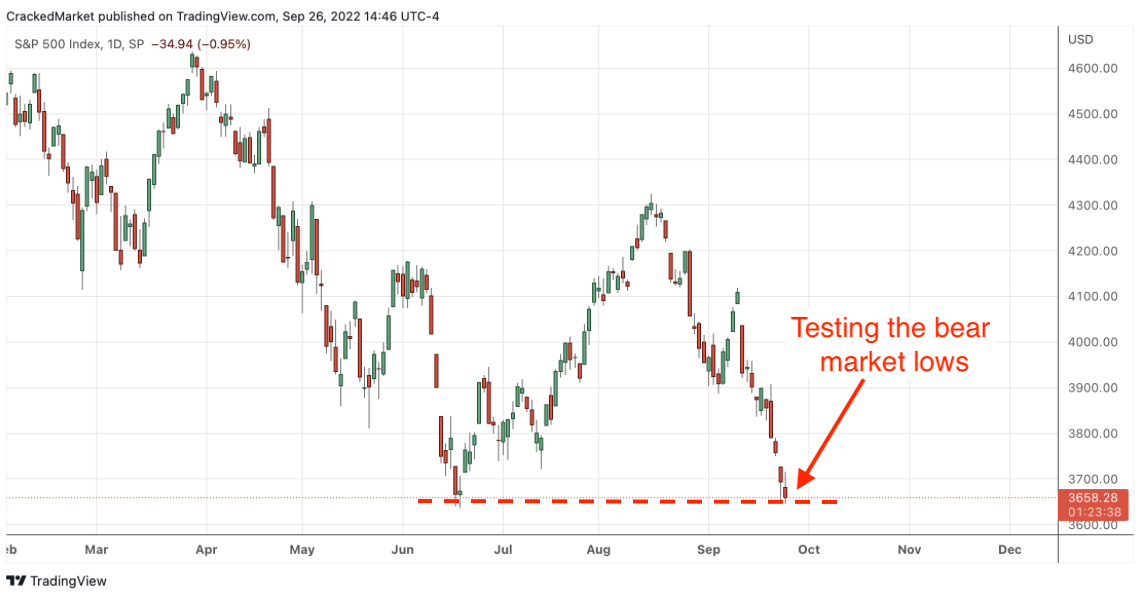

The S&P 500 attempted another bounce Friday morning. Unfortunately, that late morning buying proved fleeting and the index slipped into the red by the close, setting yet another fresh 52-week low.

Friday’s loss makes it -2.9% for the week and the sixth weekly decline out of the last seven. That hurts, but it definitely feels like the selling is losing momentum near the old lows.

Monday’s close was the first fresh 52-week low since this summer. Following Monday, we set a further three 52-week lows. But as dire as four 52-week lows in a week sound, the market dropped less than half a percent on average since Monday’s close. While not good, this is far from panic territory.

There are two ways to interpret this. Either the market is finally running out of sellers after six weeks of exhaustive selling. Or this week’s reasonably stable trade was nothing more than the calm before the next storm.

If stocks were a lot higher, I would be far more worried about further selling. But after the market shed more than 700 points in seven weeks, we have a lot less to worry about because it can’t give back those 700 points again.

Sure, anything is possible and we could fall again next week, but the next bounce is a lot closer than most people think. The AAII sentiment survey is over 60% bearish and at a 12-month high, while the historical average is all the way back at 30%. If a person believes in trading against the crowd, sentiments has rarely been this skewed in the bearish direction.

As always, no matter how overdone the selling has gotten, the market can always get even more oversold. But it is getting harder and harder to scratch out those last few points to the downside and when this pops, boy is it going to pop.

At the very least, we should be lightening up our short positions because greed never pays. But more than that, this thing is a tightly compressed spring poised to rip. Wait for that bounce to start and then jump aboard.

As I often remind readers, the biggest and fastest rallies occur during bear markets. And the last time I checked, we are still in a bear market.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.