How savvy traders deal with their mistakes

By Jani Ziedins | Free CMU

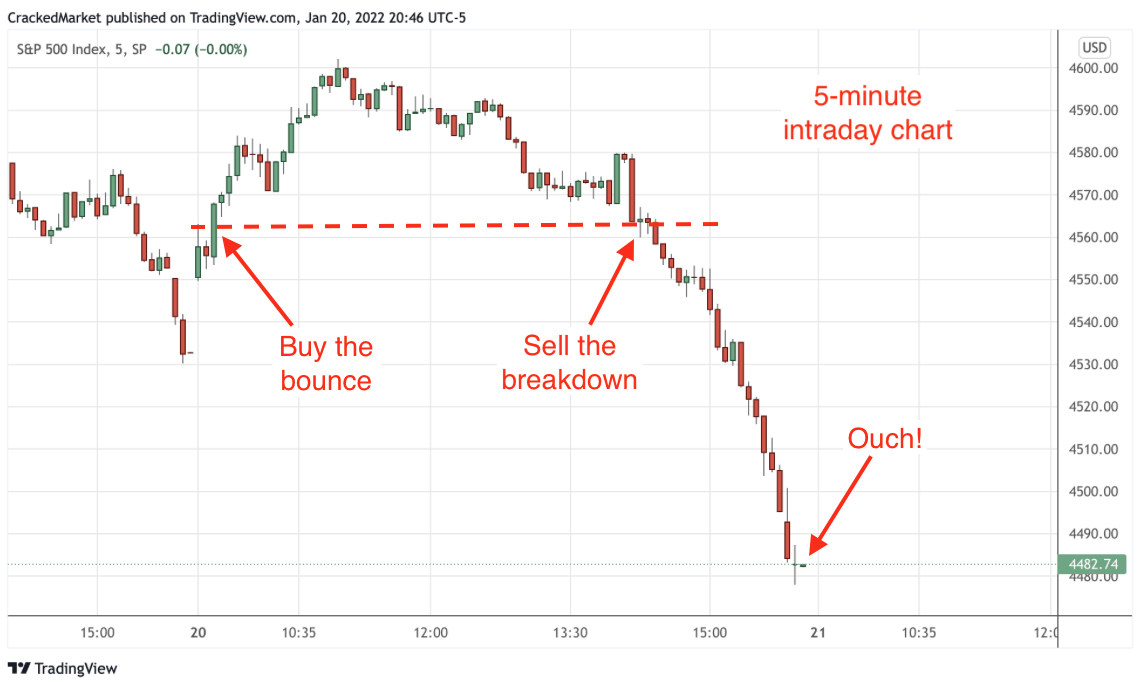

The S&P 500 added 0.7% on Tuesday, bouncing back from Monday’s ominous intraday reversal. Not bad given how poor Monday’s price action appeared.

If there is one hard and fast rule in the stock market, it is there are no hard and fast rules in the stock market.

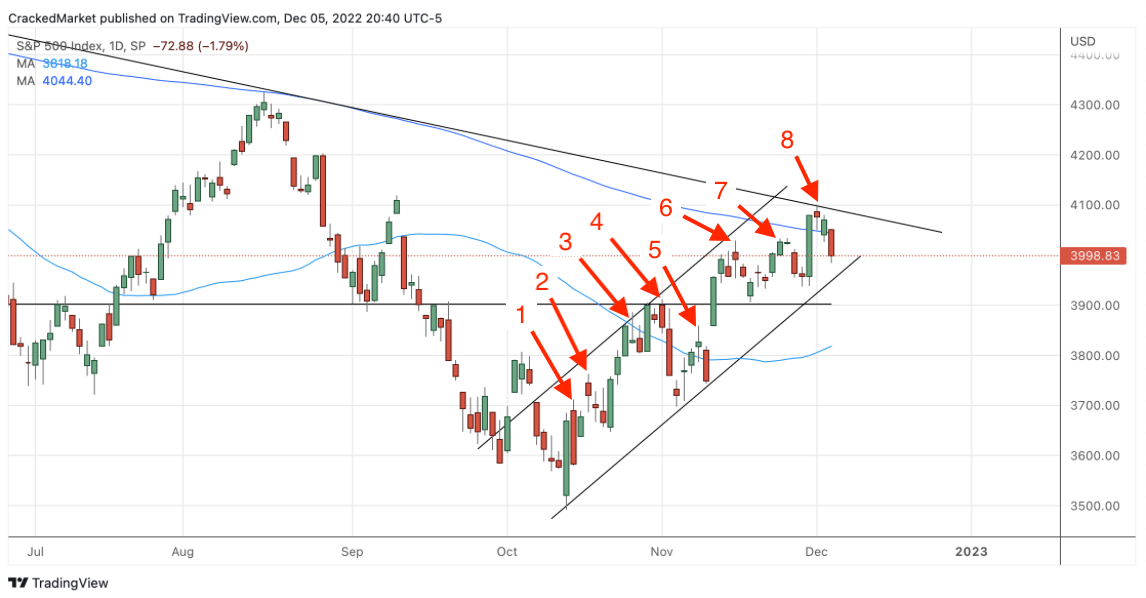

Monday morning’s impressive breakout above 3,900 resistance fizzled and evaporated by the close. That intraday reversal is about as bearish as price action gets. But as is always the case, trading signals operate in probabilities, not absolutes.

While a majority of the time price action like Monday’s leads to further declines, it didn’t happen this time, which is normal and expected. Even something that works 80% of the time will still fail one time for every four times it succeeds.

The lack of guarantees in the markets is why I always trade with contingencies in mind. Even though I liked the short setup Monday afternoon, I started with a partial position and placed a stop nearby. That way, if I was wrong, I had an exit plan in place. And it’s a good thing because I ended up using that exit plan Tuesday and that is the only reason my losses were so modest.

No one is ever right all the time, but traders that succeed over the long term make sure their trading plan limits their losses when they are wrong.

While seeing how things turned out Tuesday, it would be easy to say shorting Monday’s intraday reversal was a mistake, but starting with a small position and a nearby stop, my loss was far smaller than the potential reward if I got it right.

I will take that trade every day of the week because while it didn’t work this time, it will produce big profits more often than not.

Small losses and big rewards are how we make money in the market.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.