CMU: How a savvy trader buys the dip.

By Jani Ziedins | Free CMU

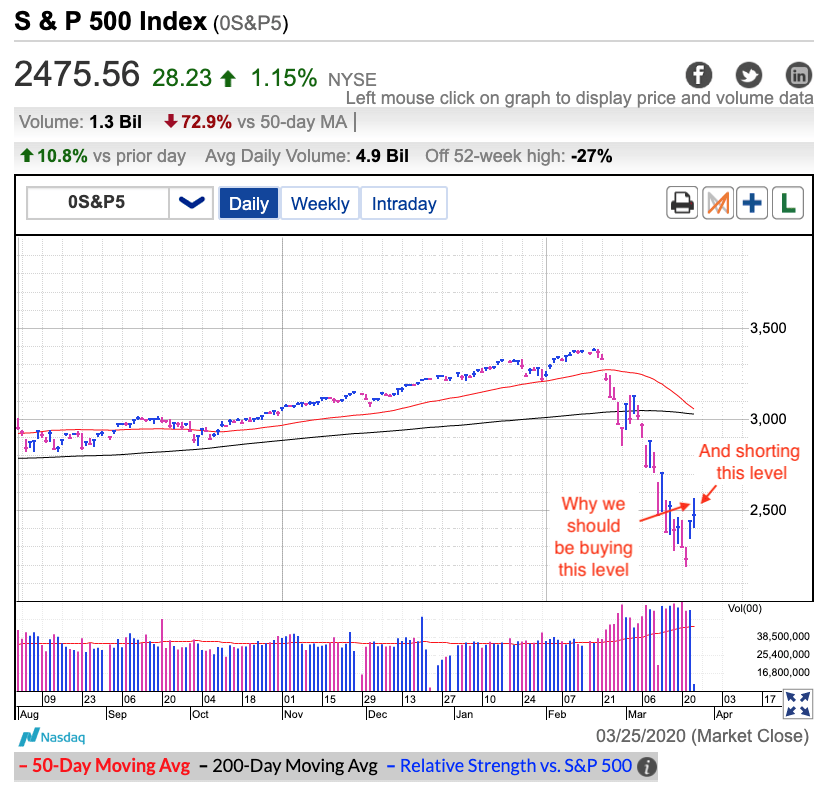

The S&P 500 fell for the third session in a row, retreating 7% from last week’s all-time highs. The spectacular implosion of the tech trade has many wondering if the Covid rally’s best days are now behind us.

First, this is one of the most hated rallies in recent memory. And to be honest, there is a lot to dislike about this market, namely hitting all-time highs in the middle of the biggest economic collapse since the Great Depression. But let’s not allow these minor details to cloud our judgment. This market has been ignoring fundamentals for six months and there is little reason to believe anything changed now. If the headlines didn’t matter then, they probably don’t matter now. And if the market doesn’t care about these things, then neither should we.

Second, arguing with this rally has become a national pastime. Since the earliest days in April, critics have been bashing this strength. As you can see from the above chart, there have been at least 9 different times this market allegedly died. Is there a reason to believe this time will turn out any different?

Without a doubt, this rally will die like all the others that came before it. But if I’m a betting man and there are 10 chances one thing will happen while only 1 chance something else will happen, I’m sure as heck putting my money on the thing that happens 10x more often. This is just a simple numbers game.

While this dip will most likely bounce, that doesn’t mean we can be reckless with our trades. First, I will assume everyone who reads this free blog already locked-in profits when the market first retreated under 3,500. This is where our trailing stops should have been and those would have gotten us out.

Now that we’re in cash, the challenge is knowing when to get back in. Is three days of selling enough? Or will it be five? Or seven? I have no idea and that’s why the savvy dip buyer assumes every bounce is real. While that leads to premature entries, those are not a big deal if we manage our risk properly.

First, we start small. That means entering with a quarter, third, or half of a normal-sized position. That way if we’re wrong, our mistake doesn’t hurt very much.

Second, we buy the bounce early so we can place a nearby stop just under the lows. If the bounce fizzles and retreats, no big deal, we get out and try again. While this often leads to a hand full of small losses, those will easily be overcome when we catch the next big leg higher.

And third, we only add to what is working. The real bounce will take off and it won’t look back. As long as we start early, keep a nearby stop, and only add to something that is working, our risks will be small and our eventual rewards will be large.

This isn’t hard when we approach the market with a thoughtful and sensible plan.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every day.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, have actionable analysis and a trading plan delivered to your inbox every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.