Is it time to get scared?

By Jani Ziedins | End of Day Analysis

Volatility came roaring back Tuesday as the S&P500 plunged 1.3%. The most noteworthy headline was 10-year Treasuries topping 3% for the first time in several years.

Rising interest rates are one of those half-full, half-empty things. Interest rates are recovering to more normal levels as we finally put last decade’s financial crisis behind us. But a big portion of the stock market’s strength comes from high valuations due to ultra low-interest rates. Stocks and bonds compete for investment dollars and when bond returns were laughable, a lot of bond investors turned to equities for better returns. But now that bonds are becoming more attractive, some of that money is flowing back into bonds.

The thing to remember about today’s 3% headline is bond prices have been rising since Trump’s election. For practical purposes, 3% is no more significant than 2.9% or 3.1%. The round number simply makes for a better headline. Will 3% change anything, probably not. If the market didn’t care about 2.5%, 2.7%, or 2.9%, then 3% won’t matter either. This market has been incredibly resilient because confident owners refused to sell every bearish headline thrown at it over the last three months. Will this time be different? Not likely.

Two weeks ago I wrote the following in my Free-After Hours Analysis and it still every bit true today:

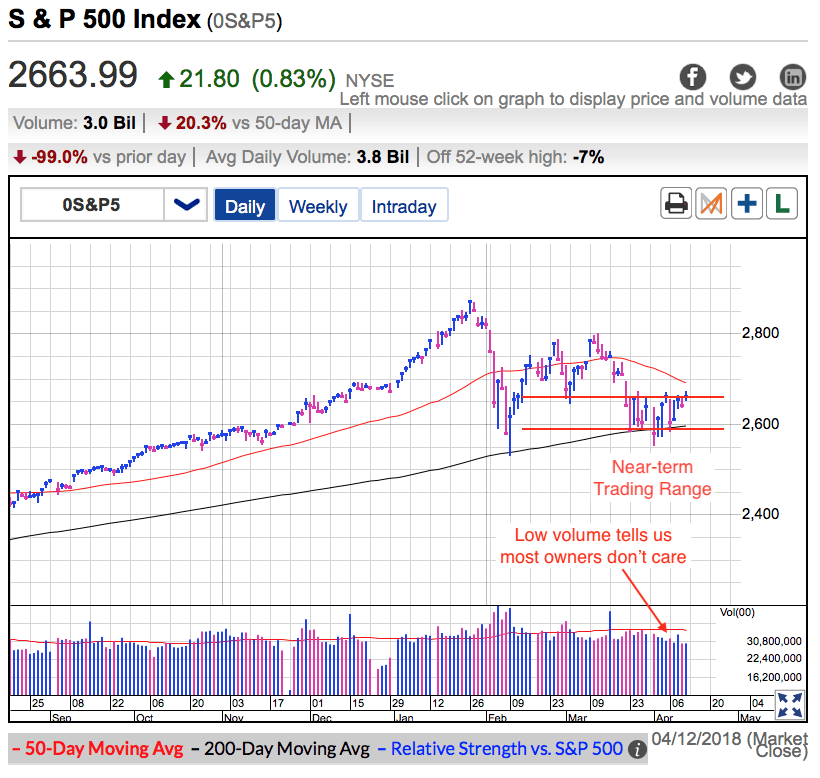

“Technically we are at the upper end of the latest trading range and that leaves us vulnerable to a dip back to the lower end of the range and even a test of support. But that won’t change anything. This weakness would be a buying opportunity, not an excuse to sell stocks. This is a resilient market and these discounts are attractive. A couple of months ago people were begging for a dip so they could get in at cheaper prices. The market answered our prayers. Don’t lose your nerve now.”

The thing to remember about market crashes is they are brutally quick. We’ve been trading sideways since February’s selloff. That is in the face of relentless bearish headlines. If this market was going to crash, there have been more than enough excuses to send us tumbling a long time ago. Instead of selling these bearish headlines, confident owners are holding for higher prices. When owners don’t sell bad news, it stops mattering. That is what happened over the last 90 days and it is what is going to happen here.

If the market is in a trading range, should we be buying this weakness or selling it? Most people lose money in the stock market because they buy when they feel safe and they sell when they get nervous. Obviously buying high and selling low is a horrible strategy. What we really want to do is buy low and sell high. But that is a lot easier to say than it is to do. That means we need to zig when everyone else zags. That means buying when everyone else is selling. The best trades are often the hardest to make.

Everyone’s favorite FAANG stocks got hammered today. But this isn’t a surprise. These highfliers magnify the market’s move in both directions. They go higher than everything else, but that also means they get hit the hardest on bad days too. Weeks ago people were begging for a pullback so they could get in. The market answered their prayers. The question is if any of those people have the courage to buy. While we could see a little more near-term weakness, months from now people will be kicking themselves for not buying more at these levels.

Jani

If you found this post useful, share it with your friends and colleagues!

If you want to be notified when new posts are published, sign up for Free Email Alerts.

For less than $1/day, have analysis like this delivered to your inbox every day during market hours.

You must be logged in to post a comment.