The easy way to trade this market volatility. Plus what to do with TSLA at these levels

By Jani Ziedins | End of Day Analysis

The S&P 500 took us on another wild ride Wednesday.

The session started off well enough with the index spending most of the day up a healthy 2%. Unfortunately, the Fed rained on the market’s parade when they hinted at the possibility of a more aggressive rate-hike schedule than many investors expected.

As much as bulls and bears want to argue over what this means for stocks, for savvy traders, the process is fairly simple. Either this is a non-event and prices make their way back to the highs over the next few weeks and months. Or the market is about to implode in a death spiral of panicked selling.

Option A we go up. Option B we go down. Why bother picking sides when it will be easy enough to simply follow the market’s lead? That’s what I will be doing.

The only thing that matters to me is the market does something. If I’m fully honest, it would be nice to see stocks fall a little further because cheaper is always better. But if it wants to go higher, I’m fine with that too.

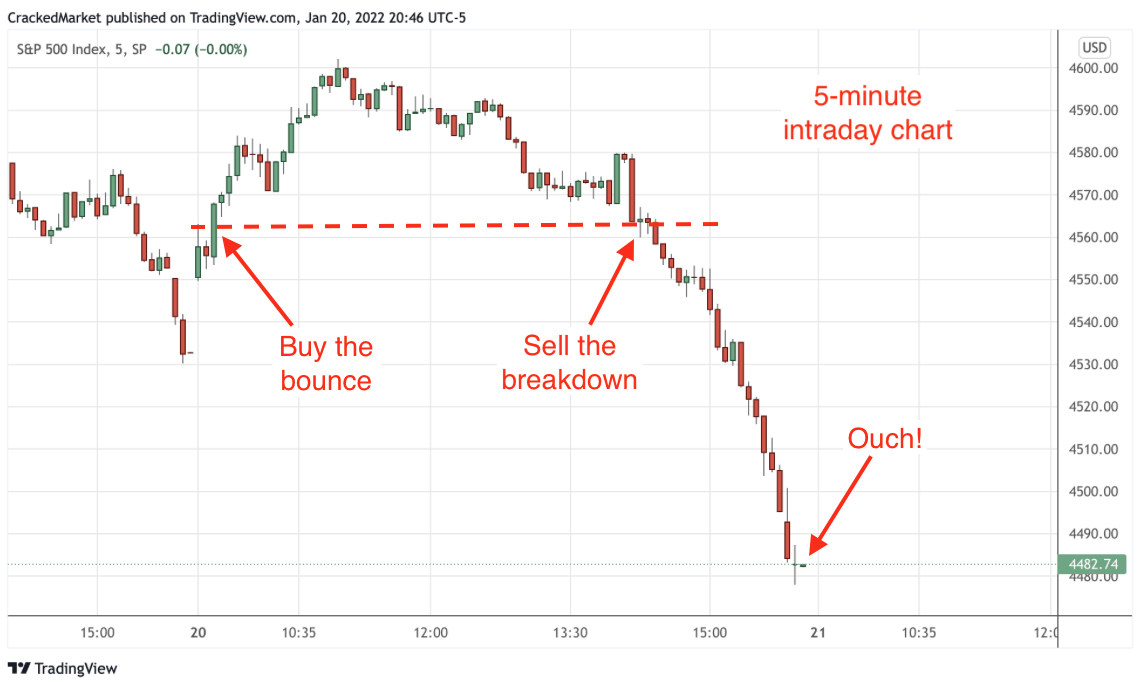

Buy the bounce, sell the breakdown, and collect my profits. It doesn’t really get any more straightforward than that.

As for how I’m trading this. As I explained in my previous posts this week, I bought Monday’s bounce and was adding to that position with stops at or above my entry points. Things were looking really good Wednesday when the rebound was hitting new highs. But the Fed came along and changed all of that.

This remains an emotional and volatile market and there are no half-steps. When the market started falling Wednesday afternoon, that was our sign to get out. Holding and hoping for a quick bounce wasn’t an option. This market moves too fast to think like that. Pull the plug quickly and start looking for the next entry point.

If a person acted decisively enough, they pocketed some nice profits locking in this week’s swift bounce from Monday’s lows.

While it’s nice to pocket a few bucks, we are always looking toward what’s coming next.

Maybe the index bounces Thursday, giving us another nice entry. Or maybe the panic selling sends us crashing under Monday’s lows. Either way, I’m perfectly content being a little late than a lot early. I’ll let other people argue about what stocks “should” be doing. Instead, I’ll stick with trading what it “is” doing.

Buy the bounce and sell the breakdown. Start small, get in early, keep a nearby stop, and only add to a position that is working. And if I get dumped out, no big deal, I wait for the next bounce and try again.

Follow a simple trading plan and this isn’t nearly as difficult as most people make it out to be.

Sign up for free email alerts so you don’t miss the next trading opportunity.

TSLA reported historic profits after the close but the stock barely moved in after-hours trade. While flat isn’t as exciting as up, it sure beats going down. That tells us most investors were expecting this result and are comfortable with these valuations.

More important is this week’s bounce off of $850 is still intact. Stick with this bounce as long as it remains above support and see where this trade goes.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.