Should we be selling the dip or buying it?

By Jani Ziedins | End of Day Analysis

The S&P 500 started the day with modest losses and even rebounded back to breakeven. But moments before lunchtime, the crowd got spooked and prices fell off a cliff.

If you believe the financial press, this waterfall selloff was triggered by a renewed fear of the Coronavirus epidemic and the impact it is having on the economy. Were these recycled headlines really worth falling nearly 30-points over just a few minutes? Or was something else at play?

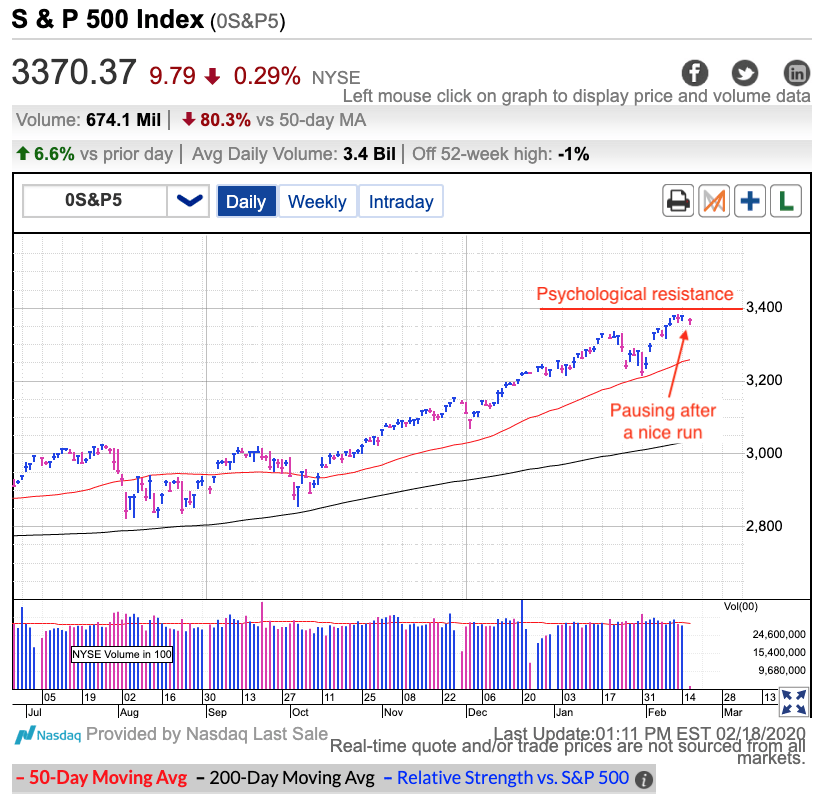

As I wrote previously, here, here and here, this market likes to slow down and consolidate gains near the round 100-point levels. It has been a nice, nearly 200-point rally since the February lows. To expect this rate of gains to continue indefinitely would be a tad nieve.

If the market was going to pause at these levels anyway, it doesn’t really matter what the headlines are. Supply and demand needs some time to catch up and is the real reason stocks stalled under 3,400 this week. If it wasn’t these headlines, it would have been something else. Rally this far and inevitably you run out of new buyers. It is that simple.

Now that we know the real reason behind the market’s stumble, we are in a better position to figure out what comes next. Since this wobble was triggered by a supply and demand imbalance, not a fundamental change in the market’s outlook, this is nothing more than a routine and healthy dip. The kind that bounces within days, if not hours.

If we understand why the market is doing what it is doing, we are far less likely to overreact to these periodic wobbles. If a reader has been following along, they knew this was coming and included this possibility in their trading plan. Hopefully, you were taking some profits proactively last week and had cash ready to buy the dip. If not, don’t worry about it, there is always next time. Just make sure you create a plan ahead of time that includes possibilities like this and you won’t worry about days like today. In fact, you’ll be happy to see them because they are profit opportunities for those of us that come prepared.

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every week.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, have actionable analysis and a trading plan delivered to your inbox every day during market hours

Follow Jani on Twitter @crackedmarket

Tags: S&P 500 Nasdaq $SPY $SPX $QQQ $IWM

You must be logged in to post a comment.