What smart money is doing with their short positions

By Jani Ziedins | End of Day Analysis

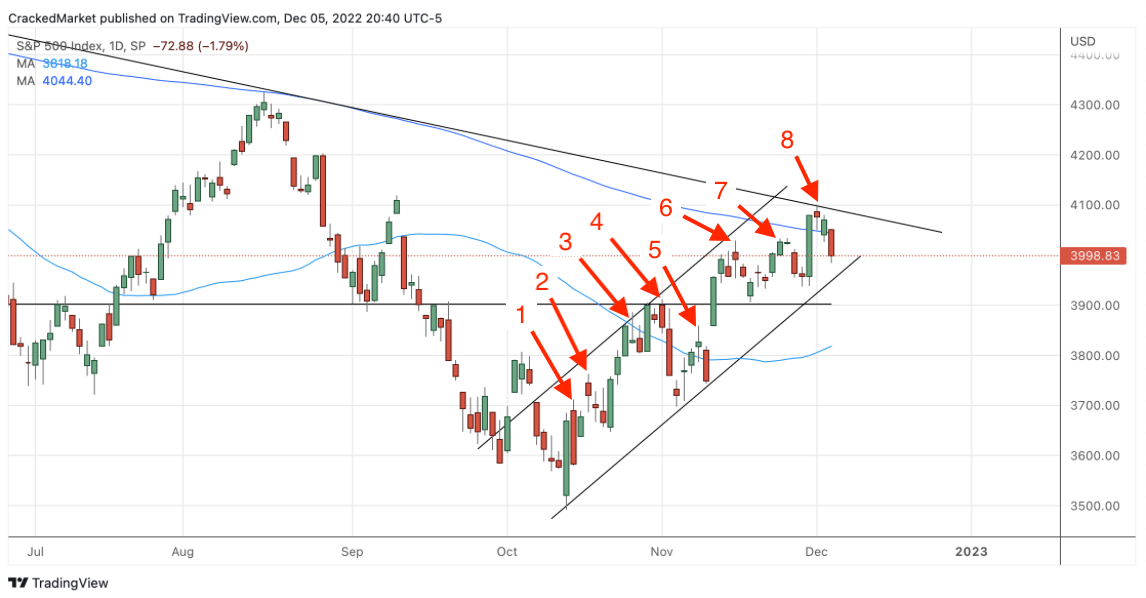

The S&P 500 fell another 1% on Friday, making this the third down day since Wednesday’s Fed meeting. But as dire as that sounds, the index only lost 2% this week. While not great, this is hardly free-fall material.

Powell did his best to rain on the market’s parade, but it is unlikely his comments changed many peoples’ minds. Those that were bearish Wednesday morning are just as bearish today and those that were bullish are just as bullish.

Obviously, the bulls didn’t get that warm and fuzzy feeling from Powell’s press conference, but that lack of comfort hasn’t translated into a panic on the streets yet.

Inflation is moderating, the labor market remains tight, the economy is chugging along, and the Fed promises to fight inflation to the end. So pretty much everything that we knew last week. And if this is what we were thinking last week, there is no reason for stock prices to deviate in a significant way from where they were last week. Find support near 3,800 and this week’s selloff is nothing more than a routine bit of down following a nice bit of up.

Having shorted the post-Fed crash on Wednesday, I’m sitting on a nice pile of profits. At this point, I’m far more paranoid about losing those profits than interested in pushing my luck to make a few more bucks. I took some partial profits Friday afternoon and I will sell even more Monday if prices bounce.

Maybe the reflexive selling extends into next week and I’m selling these partial positions too soon. But that’s okay because taking worthwhile profits is never a mistake. I know I can’t pick the bottom, so I’m not even going to try. If the selling continues, I will profit from the partial positions I’m still holding, so it really is a no-lose situation for me.

As for what comes next, if prices bounce Monday morning, I’m closing the remainder of my shorts and even going long if those early gains persist for an hour or two. Starting small and putting a stop under the early lows would be a great, low-risk entry.

But my perfect setup would be a sharp selloff Monday morning that falls over three percent before bouncing hard in a capitulation bottom. I don’t think we will be that lucky, but that is what I’m hoping for.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.