Are savvy traders running from this market or are they getting ready to buy the next bounce?

By Jani Ziedins | End of Day Analysis

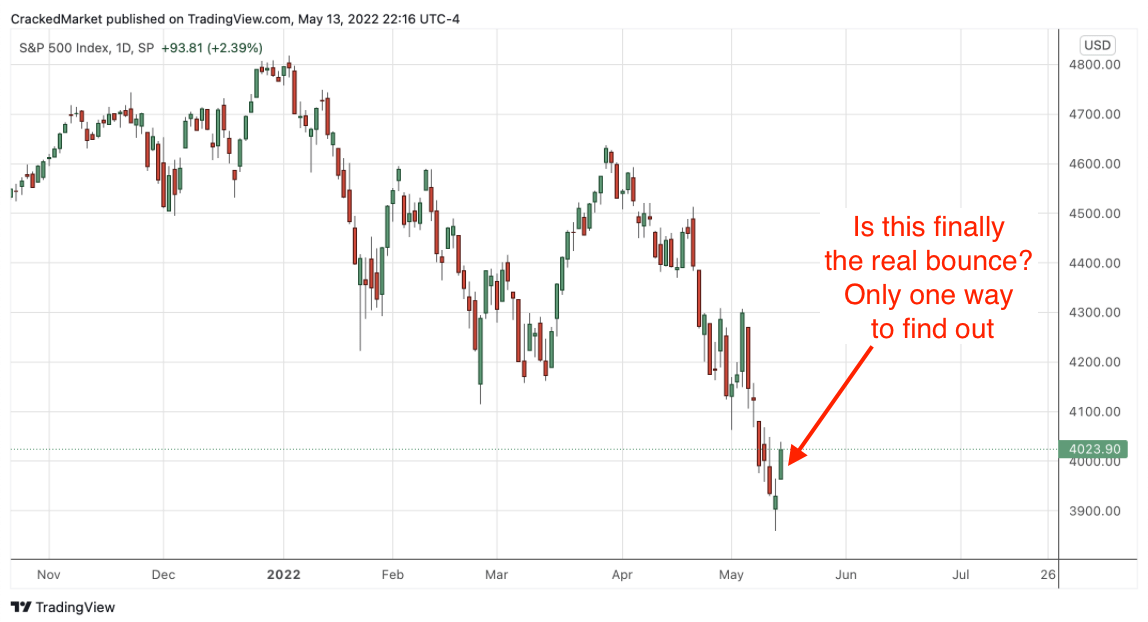

So much for the Fed bounce, the S&P 500 gave back all of Wednesday’s gains and then a chunk more, finishing at the lowest levels in a year and a half. Ouch!

Gas is pushing $5/gal, mortgage rates are creeping up to 6%, consumer confidence is tumbling, and inflation remains stubbornly stuck at 40-year highs. Oh yeah, and there’s the biggest war in Europe since WWII. But other than that, things are going pretty well.

As poorly as everything feels, stocks are not oblivious and their nearly 25% decline reflects a lot of this pain.

Most bear markets bottom out between 25% and 30%, meaning we are most of the way there for a vanilla bear market. There are exceptions, like the Great Depression and the Great Recession, but the banking system nearly imploded in those episodes and for a repeat, we’d need to see something equally terrifying.

While $5/gal oil is painful, the biggest problem we have right now is most people have too much money and are bidding against each other for housing, cars, and everything else that is in short supply. Our biggest problem is the economy is too hot and the Fed is trying to cool things off.

Does that sound like our current situation has anything in common with the worst bear markets in history? No, not really.

And so while people are afraid of how much worse this will get, it is a little late to be worrying about that kind of stuff seeing as how most of the damage has already been done to stocks.

Maybe this grinds sideways for a year or two, which wouldn’t be a big surprise. But fearing a 40% or 50% selloff from the highs doesn’t match our current economic situation.

As for how to trade this, while Thursday’s 3.3% decline sounds bad, stocks ground more sideways than anything following the gap lower at the open. That means few people were rushing to sell stocks through the day, which is the first thing that needs to happen before we find a bottom.

Maybe we get a little more selling on Friday, but everyone knows markets moves in waves and after falling more than 500 points over a handful of days, the next near-term bounce is just around the corner.

I covered my short Wednesday, which proved to be a little early, but that’s the way this goes sometimes. Once we realize only fools try to pick tops and bottoms, that means accepting we will always cash in a little too early or a little too late. That’s just the nature of the game.

But now that I’m out, I’m already looking to get back in. The next trading opportunity that excites me most is a nice bounce back to 4k resistance. It could start as soon as Friday, so be ready.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.