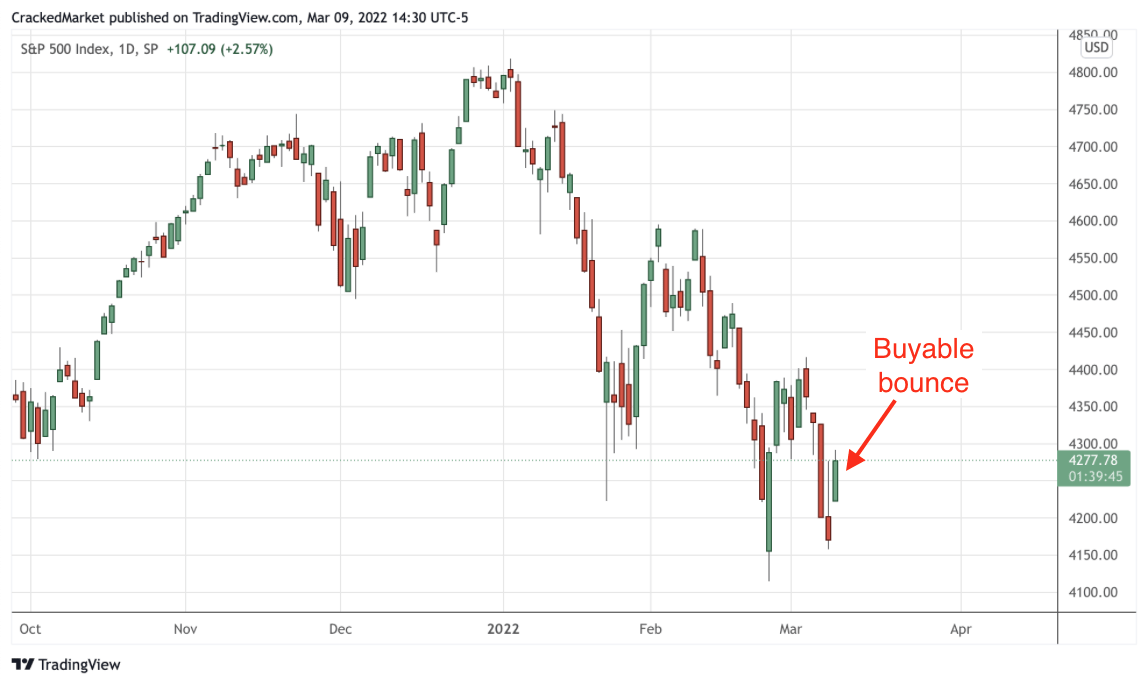

Why this week’s big bounce was inevitable

By Jani Ziedins | End of Day Analysis , Free CMU

The S&P 500 surged 290 points since Monday’s close and is now sitting at the highest levels in a month. And to think, five days ago the crowd was predicting another big crash. So much for conventional wisdom.

In percentage terms, the index is up 6.9% since Monday’s close. Catch this wave in a 3x ETF and now we’re talking about real money! Not bad for a week’s worth of “work”.

Now, I wish I could say I knew the market was going to bottom Monday afternoon and rally sharply the rest of the week. Unfortunately, I’m not psychic and was along for the ride like everyone else.

But while I couldn’t predict the exact when and where this rebound was going to happen, I knew the odds of a sharp bounce were good. This is a volatile market and that means oversized moves in BOTH directions.

First, the market loves symmetry, meaning big drops are followed by big bounces.

Second, headlines are dreadful, but they haven’t been getting worse. The correction since the January highs priced in a lot of bad news. Owners that fear these headlines have been given plenty of time to bail out of the market and have been selling to far more confident dip buyers.

And third, as I’ve written before, the market hates uncertainty more than bad news. While nothing is getting better, we can finally quantify what we’re dealing with. Ukraine is horrific, but it isn’t turning into WWIII. The spike in oil prices stabilized in the low $100s. And the Fed is only planning to push interest rates up near 3%.

While none of this qualifies as good news, it wasn’t as bad as some people feared and stocks have rebounded in a “less bad than feared” trade.

Given the above, I knew the market was poised for a big bounce, what I didn’t know was when. And that’s why I started buying bounces the week before. When I don’t know which bounce will turn out to be the real bounce, the only way to make sure I don’t miss it is to buy all of the bounces.

But rather than do this in a reckless, pick a spot and wager everything on it sort of way, I start small, get in early, and keep a nearby stop. When a bounce fizzles and retreats, no big deal, I get out and wait for the next bounce. And when that one fizzles, I get out and try again.

Two weeks ago people thought I was crazy buying these bounces. But markets don’t bottom until most people have given up. That simply means I need to be more persistent than the average trader.

Some of my early buys turned a small profit. Others broke even. And a few lost a few bucks. Throw all of those trades together and it was largely a wash. But more important than the profit or loss on those small trades is I was ensuring I would be standing in the right place at the right time when the real bounce finally came along.

I’m more than happy to lose a few dozen points on a 1/3 position when the potential upside is 300 points on a full position. This is the kind of risk/reward traders dream of! All it takes is the vision and courage to buy when everyone else thinks we’re foolish. Four days later and who’s the real fool?

At this point, there is nothing to do but lift our stops up near 4,400 and see where this goes. (You bought the bounce on Tuesday, right?)

Sign up for free email alerts so you don’t miss the next big trading opportunity.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.