Why nimble traders are buying this bounce. Plus why AAPL’s pop shouldn’t surprise anyone

By Jani Ziedins | End of Day Analysis

Give the stock market lemons and sometimes it makes lemonade. A strong rally Friday afternoon turned what would have been the fourth consecutive losing week for the S&P 500 into a winner. And boy, did we need this winner.

Headlines haven’t changed in a meaningful way and the Fed’s Taper and Rate Hikes are just around the corner. While those headlines triggered the first stock market correction since the original Covid selloff, the market seemed to find its footing this week.

The resilience started Monday afternoon when a midday 4% bloodbath reversed and surprisingly enough, turned into a 0.3% gain by the close. As shocking as that rebound was, most investors remained skeptical and the index continued probing 4,300 support all week. But much to the chagrin of bears, 4,300 withstood 4 different assaults before the market eventually closed Friday above 4,400.

Not bad. Not bad at all. Especially given where this could have gone.

As I’ve been writing all week, these things always look the worst moments before they turn around. By rule, they have to. If it didn’t look bad, people wouldn’t sell and prices wouldn’t fall. And the thing to keep in mind is these things don’t bounce until the crowd has been demoralized and given up.

While a few days holding 4,300 support doesn’t mean this correction is over, it does look good and that means nimble traders are riding along.

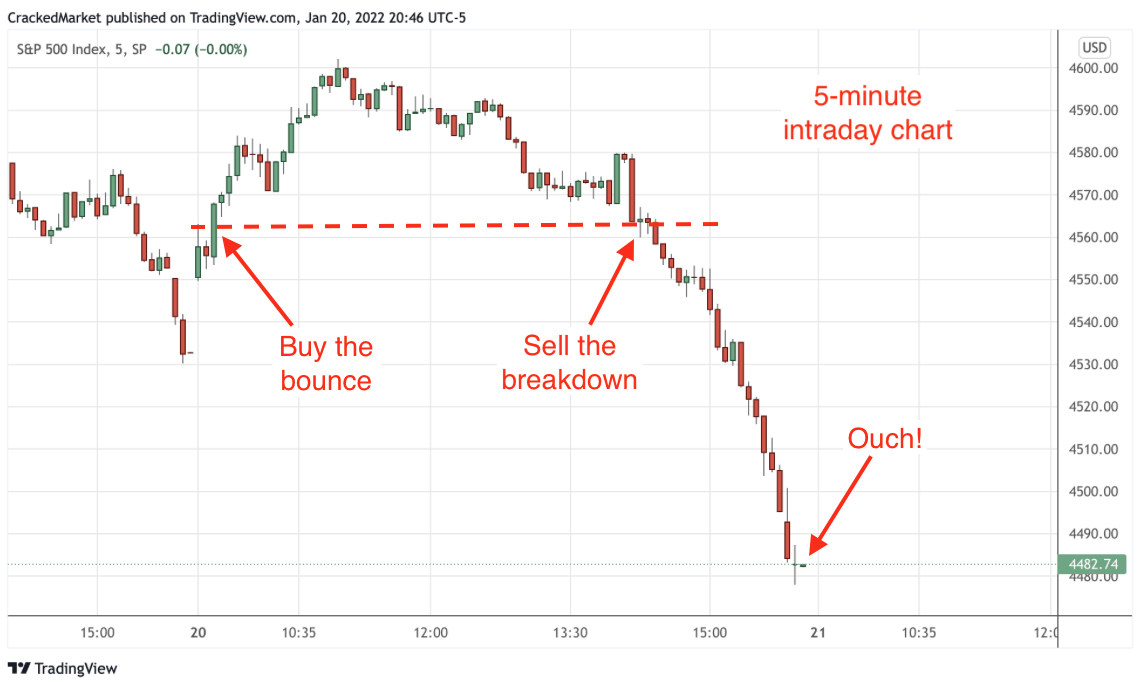

No one knows which bounce will be the real bounce. But as nimble traders, that isn’t a problem. Rather than pick sides and guess, we treat every bounce as it were the real deal until proven otherwise.

Buy the bounce, start small, get in early, keep a nearby stop, and only add to a trade that is working. Follow those simple rules and this is actually a really low-risk way of trading this volatility. Get in near the bottoms of these bounces and a few hours later we have a nice profit cushion protecting our backside.

Move our stops up to our entry points and if the selling resumes, we get out for what we paid. Big rewards for catching the rebound and small risks if we get it wrong? What’s not to like about that?

Now, don’t get me wrong. Nothing in the market is easy. And plenty of bounces fail. But if we are okay with chasing our tail a few times, by keeping at it, we ensure we will be standing in the right place at the right time. And catching the next big wave higher will make it all worthwhile.

If most people lose money buying the tops and selling the bottoms, shouldn’t we do the opposite?

I bought a partial position Friday morning and added more Friday afternoon. If prices retreat on Monday, no big deal, I get out and try again next time. But if the bounce keeps going, I will be sitting on a pile while everyone else is wondering if they should get in.

Sign up for free email alerts so you don’t miss the next market turning point.

It’s been a rough few weeks for AAPL as this market darling was weighed down by external market pressures. But a shift in investor sentiment didn’t change AAPL’s fundamental business model and the company shattered earnings expectations Thursday evening. And the most valuable company in the world got 7% more valuable Friday.

Not bad for those that still believed in this company. While smart investors use trailing stops to protect their profits, just because we get out doesn’t mean we cannot get back in. In fact, the first thing we should do as soon as our stops get us out is start looking for that next opportunity to get back in.

Monday’s crash and bounce was remarkable for all the reasons I mentioned previously. This stock was bound to bounce and it was only a matter of time. So when it finally bounced, savvy traders were ready. Buy the bounce and put a stop under the lows. It really isn’t that hard.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.