Why this week’s dip could finally be the start of a larger selloff

By Jani Ziedins | End of Day Analysis

It’s been a rough week for the S&P 500 as Thursday’s 0.5% loss makes this four down days in a row.

Monday was Labor Day, making this unofficial start of the fall trading season. It’s been a nice and easy summer and a trend is far more likely to continue than reverse, but if the market’s mood is going to change, this transition in seasons is a good time for it to happen.

There isn’t a quantifiable reason to claim this rally is running out of gas and this week’s dip is different than all of the other failed dips this year. But just knowing where we are and where we’ve come from, it feels like this time could be different.

As I often write, how we finish is far more important than how we start and by that measure, Thursday’s was an ugly day. Early gains evaporated and the index crashed through 4,510 and 4,500 support on its way to closing near Wednesday’s lows.

I don’t mind red days that finish well above the early lows. In most instances those are bullish signals. But there was nothing bullish about Thursday’s retreat and close at the daily lows.

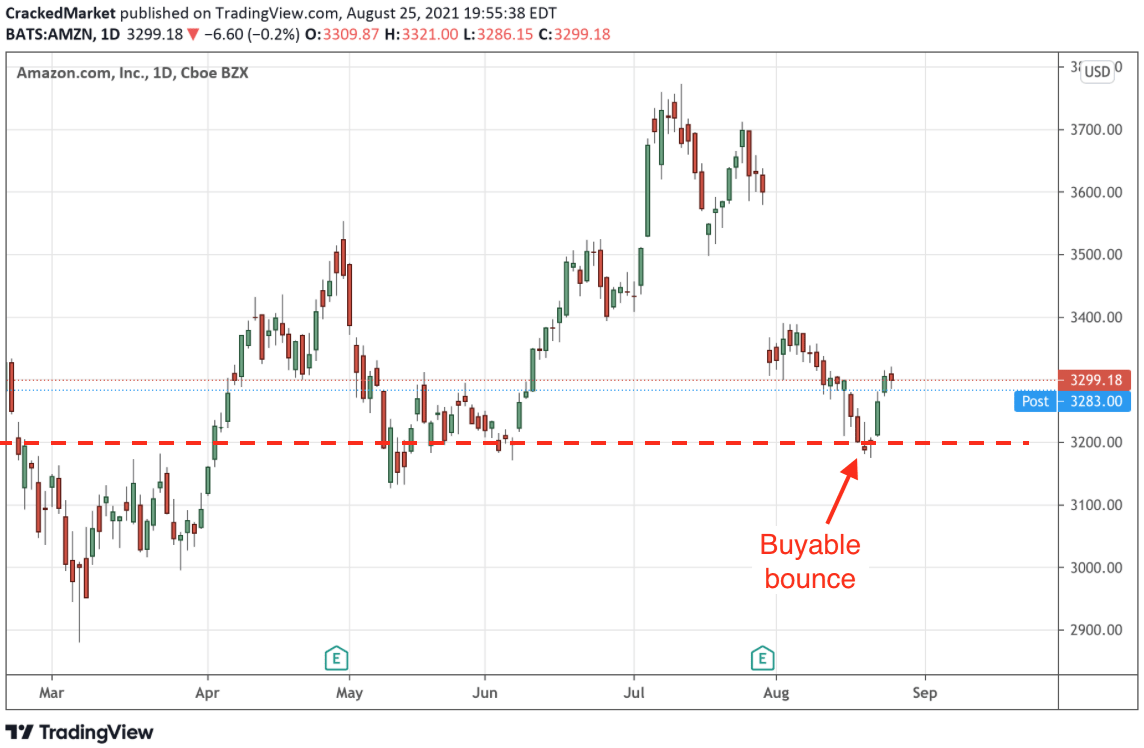

I had my stops spread across the upper 4,400s and lower 4,500s and Thursday’s pathetic price action squeezed me out. Most likely this week’s stumble will turn out to be nothing more than yet another buyable dip. But for me, it’s been a nice run and that makes this a good time to lock-in some profits.

If the index bounces back above 4,500 on Friday or sometime next week, I’m more than happy to get back in. But as long as it remains under 4,500, I’m more than content watching this from the sidelines.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.