An index trade that worked as planned and a $NFLX trade that was postponed until Thursday

By Jani Ziedins | End of Day Analysis

Following two days of selling, the S&P 500 came roaring back Wednesday and added 0.9%.

Not bad, not bad at all. As overpriced as this market seems, dip buyers cannot help themselves.

As I wrote Tuesday, there were two ways to trade Wednesday based on the resulting price action:

Dip buyers took control not long after the open and this pullback disappeared even quicker than it came. But that’s the way this usually goes. Either dips bounce shockingly quickly or the selloff goes a whole lot further than anyone expected.

At this point, this looks like just another shockingly quick bounce.

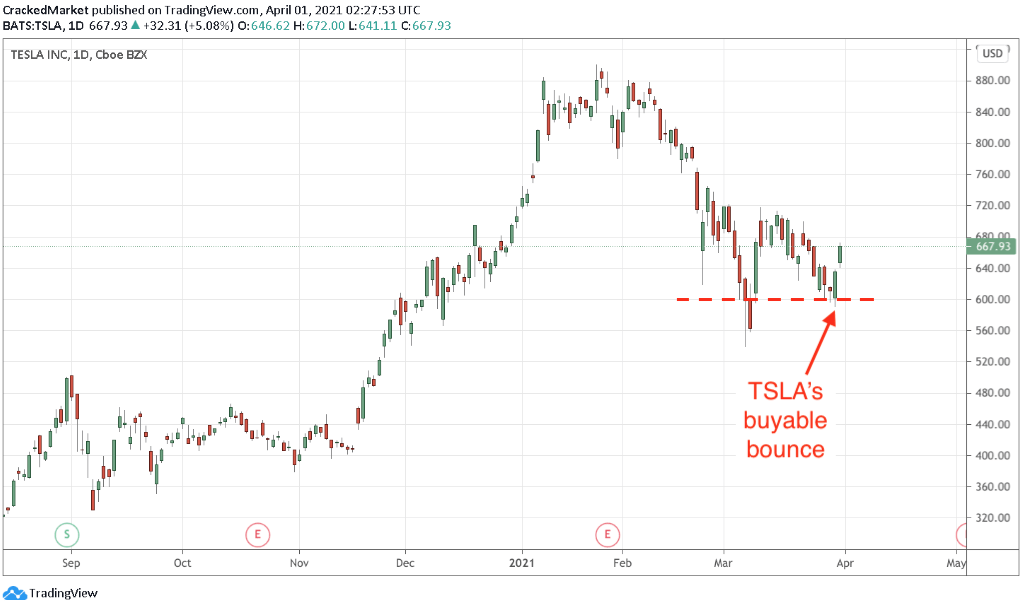

As I described on Tuesday, Wednesday’s bounce was buyable with a stop under the dip’s lows. As long as the index remains above this level, the bounce is alive and well.

But if prices fall under 4,120, the selling isn’t done yet and an aggressive trader can even try their hand at a quick short.

While the index trade worked nicely, NFLX did the one thing I least expected, hold steady following a large gap lower.

Normally, big moves either accelerate or they reverse. Almost never does the pre-market get it exactly right and put the stock right where it should be. That’s like flipping a quarter and having it land on the edge. But almost never is not the same as impossible and occasionally these things happen.

That said, I don’t expect this stability to last for long. Either the selling picks up steam or the dip buyers come rushing in. It didn’t happen Wednesday, but the same trade is still valid for Thursday.

Buy the bounce in NFLX or short the breakdown. This stock is going to make a big move in one direction or the other, we just need to wait for the market to tell us which way it wants to go. (Not bouncing Wednesday suggests dip buyers are scarce and that gives the edge to NFLX bears.)

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.