Why we should have seen this coming

By Jani Ziedins | End of Day Analysis

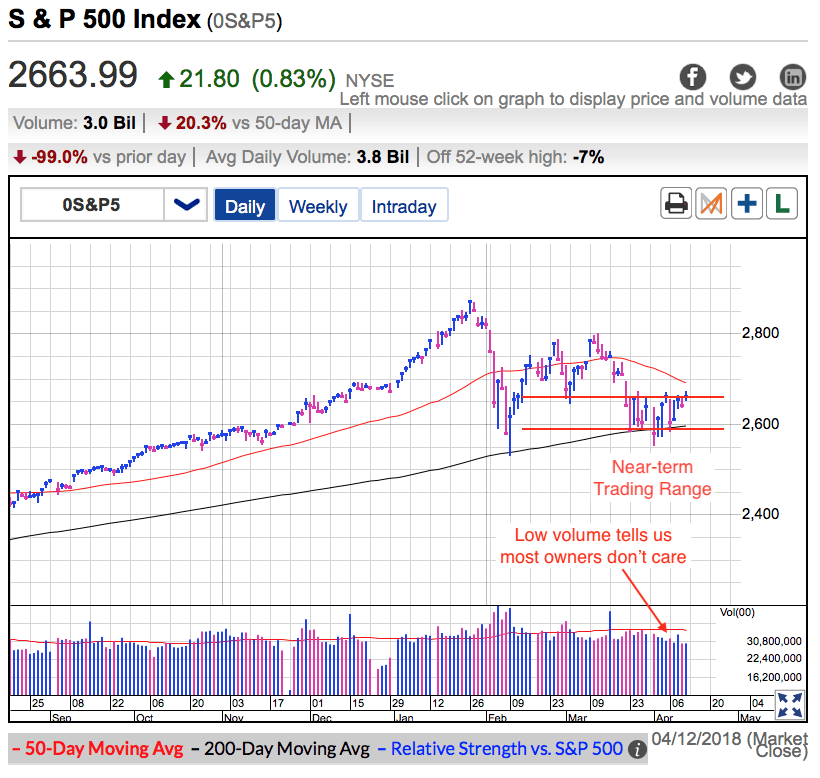

The S&P500 treaded water on Thursday following four consecutive days of gains. This week’s rally leaves us at the highest levels since March and puts us within a few percent of all-time highs. That’s a long way from the panic selling that gripped markets in early February.

I know I sound like a broken record when I keep saying this is a strong market, unfortunately a lot of people didn’t believe me when we were 200-points lower. That is the biggest frustration with trading, by the time the answer is obvious, it is too late to profit from it. But for those of us paying attention, it is possible find the answers long before it is obvious to everyone else.

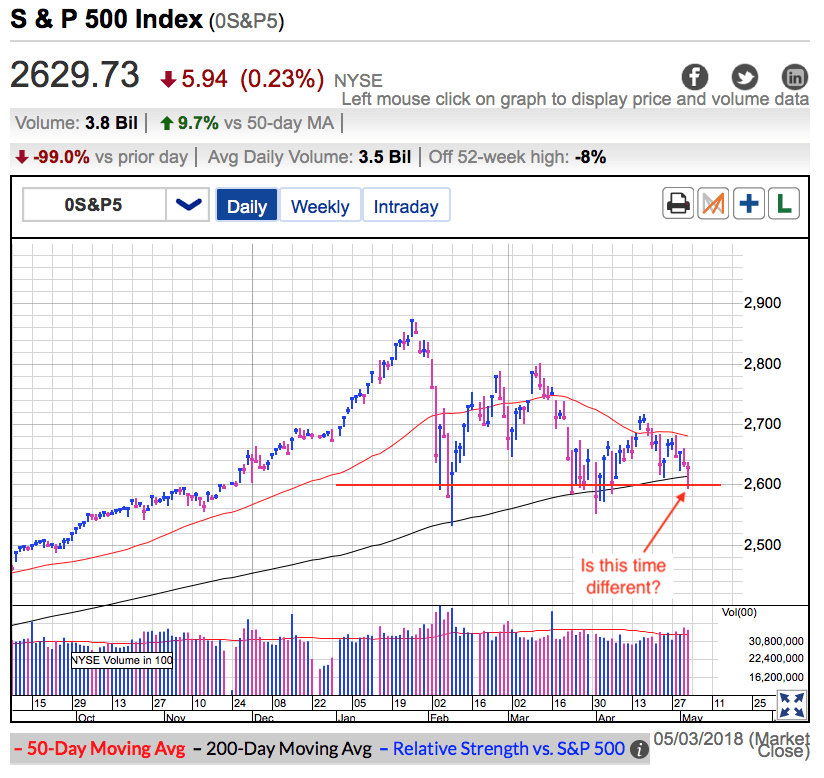

The following is a quote from my free blog back in early May, the day the market crashed under the 200-dma and 2,600 support and many were fearing the start of a much larger selloff:

“As I’ve been saying since February, we are in a trading range. That means buying weakness and selling strength. Stick with what is working until something changes. Did something change today? Nope. That means today’s weakness was a buying opportunity, not a chance to bailout “before things get worse”. Maybe we slip a little further, but that’s not a big deal. Remember, risk is a function of height. The lower prices go, the less risky it is to buy. If this market wanted to crash, it would have happened months ago. There have been more than enough excuses to send prices tumbling. Instead, every time we slip to the lows, supply dries up and prices rebound. This is a resilient market, not a weak one. And the only people losing money are the ones overreacting to these gyrations. They lose money buying when they feel confident (high) and sell when they are fearful (low). If we want to make money, do the opposite of most people. That means buying fear and selling confidence.”

Since I wrote that, the market is up 7%. I don’t have a crystal ball, but I’ve been doing this long enough to know what is real and what is market trickery. Last months selling was misleading because it was being driven by recycled headlines; Fed rate hikes, rising interest rates, Trump’s trade war, and the growing Muller investigation. All of these are real risk factors, but they became priced-in when they originally came out earlier in the year. The first and second time these stories flared up, waves of nervous owners bailed out of the market. These nervous sellers were quickly replaced by confident dip buyers who demonstrated a willingness to hold these headline risks. Out with the nervous and in with the confident. It didn’t take long for us to run out of nervous sellers and the third and fourth time these stories flared up, there was no one left to sell a recycling of these stories. When no one sells the news, we stop going down. And that is exactly what happened in early May and the same thing happened again last week.

Market selloffs are brutally quick. Hanging at these levels through countless waves of recycled headlines told us we had nothing to worry about. The most important thing to remember is we trade the market, not the news. Headlines cannot be bullish or bearish, only people’s reaction to them is what determines if they are good or bad for stock prices. And so far, everything looks pretty good.

But no one wants to hear what the market did last month since it is now obvious to anyone looking at a chart. What people want to know is what is ahead of us. I wish I could say everything looks great and we will surge another 200-points from here over the next few weeks. Unfortunately the market doesn’t work that way. In fact, most of the time it works the opposite way. Risk is a function of height. No matter how scary it felt in early May, that was one of the least risky times to buy stocks this year and the subsequent rebound proved that. But after that rebound put us at the highest level in months, the risk/reward looks far different. Everyone feels great because we rebounded off the lows, but that actually makes this one of the risker times to be buying stocks this year.

Momentum and the path of least resistance is definitely higher, but this is also the slower summer months and we are quickly approaching 2,800 resistance. That makes this a better place to be taking profits than adding new money. Anyone who bought last month’s dip should definitely start thinking about locking in some of those gains. Those that missed the rebound should let this one go and resist the temptation to chase prices higher. I’m most definitely not calling a top or predicting a large pullback, but a cooling off would be normal and expected. Everyone knows markets move in waves; unfortunately most forget that in the heat of battle.

As well as S&P500 has been doing, the FAANG stocks have been doing even better, pushing the Nasdaq to record highs this week. Back in April I wrote the following about the FAANG stocks following a particularly painful down-day:

“Everyone’s favorite FAANG stocks got hammered today. But this isn’t a surprise. These highfliers magnify the market’s move in both directions. They go higher than everything else, but that also means they get hit the hardest on bad days too. Weeks ago people were begging for a pullback so they could get in. The market answered their prayers. The question is if any of those people have the courage to buy. While we could see a little more near-term weakness, months from now people will be kicking themselves for not buying more at these levels.”

Here we are a couple of months later and no doubt people are kicking themselves for not taking advantage of those discounts. Maybe next time……

And just so people don’t think I’m a perma-bull, here is my bearish call on Bitcoin from several weeks ago, just after BTC slipped under $9k support:

Bitcoin is a completely different story. Last week’s $9k support has turned into this week’s $8k support. And thus far it is giving every indication that $7k will become next week’s support. I hope you see the trend here. Cryptocurrencies are still very much in a downtrend and we should expect lower prices. It takes most bubbles between 6 and 24 months to finish bursting. If bitcoin is like most bubbles, that means the worst is still ahead of us and we should expect lower-lows over the next few months.

And unfortunately things don’t look any better now that we have dipped to $7k support. This cryptocurrency had a very ugly May and it looks like things will only get worse. This is a long-term downtrend and lower lows are still ahead of us. Breaking $7k support will trigger to another wave of selling, but the fear won’t strike in earnest until we undercut the $6k lows. Remember, double-bottoms are a common and powerful reversal pattern. But there is a reason why no one talks about triple-bottoms, because they are not a real thing. Hit bottom three times and you are headed much lower.

If you found this post useful, return the favor by sharing it on Twitter, Reddit, Facebook and StockTwits!

Jani

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, have analysis like this delivered to your inbox every day during market hours.

You must be logged in to post a comment.