Why bears better get out of the way!

By Jani Ziedins | End of Day Analysis

The S&P 500 surged 2.5% Friday, finishing the week at multi-month highs and easily brushing off bruising earnings reports from GOOGL, META, and AMZN.

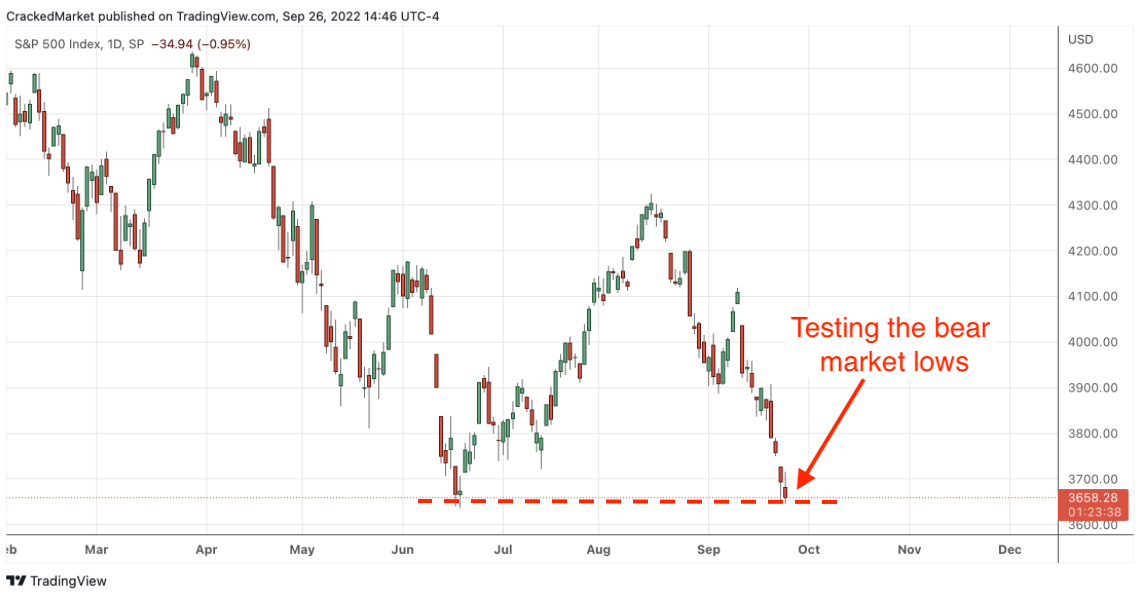

With three of the biggest and most important tech stocks deep in the red this week, you’d think the market would have rolled over and be racing toward the 2022 lows. But you’d be wrong.

As much as I don’t always agree with, or even understand, what the market is thinking, the simple truth is the market is far larger than I am and it doesn’t care what I think. Rather than disagree and argue with the market, I tell myself, “Okay, if that’s what it really wants to do, I’m happy to follow along.”

After doing this for decades, one of the most important lessons I’ve learned is to never question the market when it is doing something unexpected. That means the forces acting under the surface are so strong they overpower common sense and conventional wisdom. And if the mysterious phenomenon is that powerful, you better watch out because it will run over anyone that gets in its way.

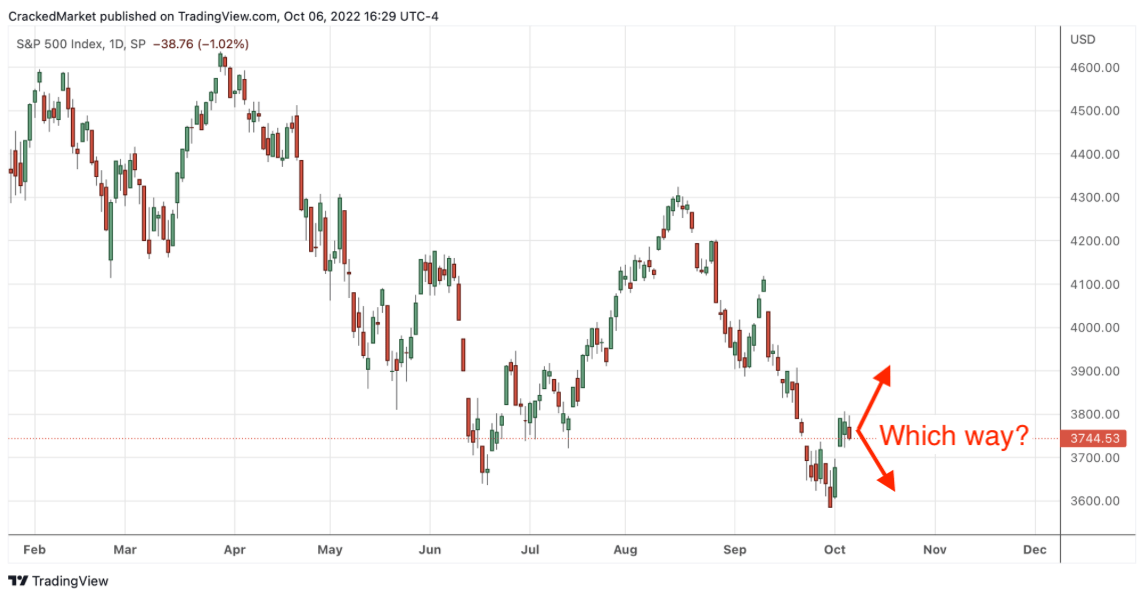

Two days ago I was preparing to lock in some really nice profits if this rebound stalled and retreated back under 3,800. It’s not that I expected a bigger pullback, just that it’s been a good run and we only make money when we sell our winners. As easy as it is to buy back in, there is no reason to stubbornly hold a position if the rebound was cooling off.

Lucky for me, the market never tested my stops under 3,800, but even if it did, the first thing I do after I get out is to start looking for the next opportunity to get in. And Friday morning’s counterintuitive strength would have been that signal to jump back in.

When something doesn’t make sense, it means there is a lot of power behind the market and we better grab on. At this point, 4k is very much in play. What happens when we get there is still up for debate, but at the very least, we should expect the market to get into the upper 3,900s over the next few days and weeks.

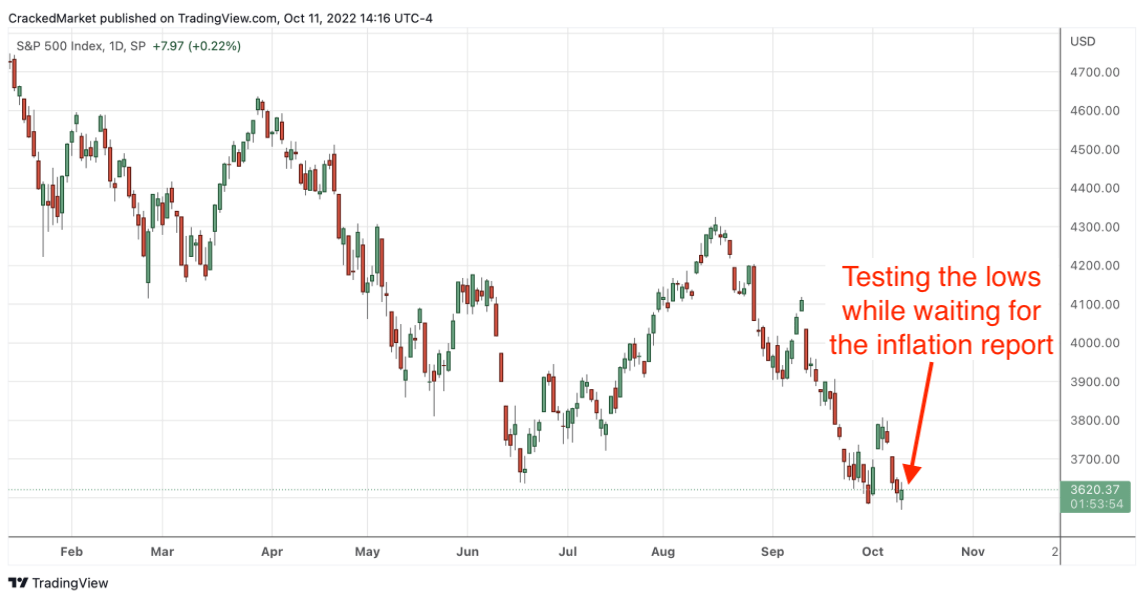

From there, we can judge the market’s price action and figure out its next move. But a nearly 500-point rebound from the October lows and it wouldn’t be a surprise to see a little profit-taking weight on the market after we get near 4k.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.