Who knew being wrong could be this profitable?

By Jani Ziedins | End of Day Analysis

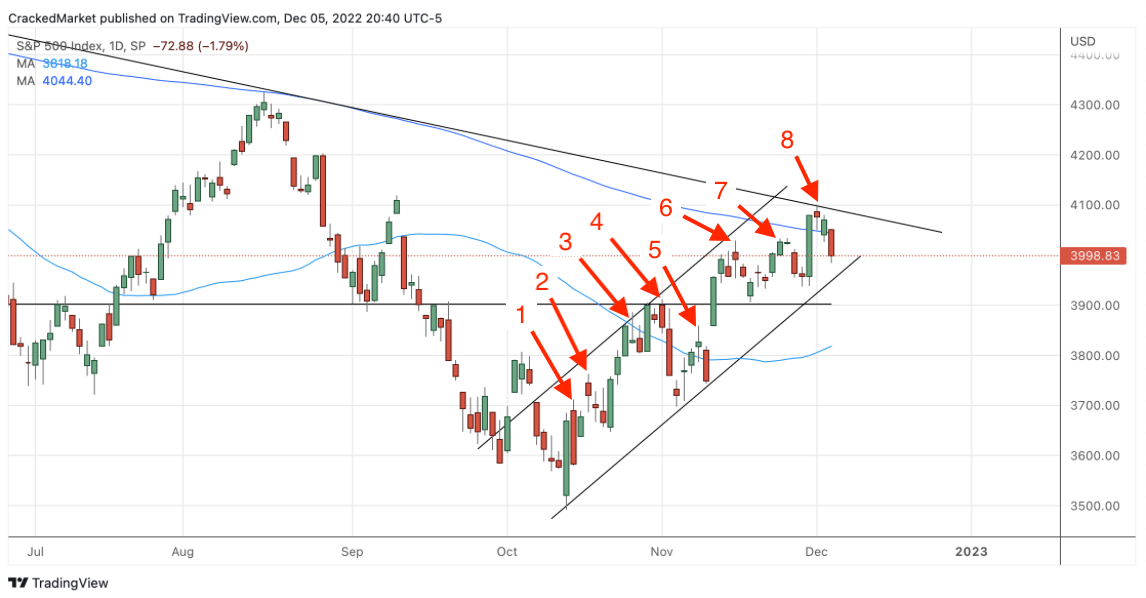

The S&P 500 extended Wednesday’s post-Fed selloff by crashing another 2.5% on Thursday.

The Fed did what everyone expected when it raised rates another 0.5%. What unnerved investors was the hard-line Powell took when answering questions about how high rates will eventually get and how long they will stay there. Long gone is the affable Uncle Jerome and he’s been replaced by the hard-edged Sergeant Powell.

But this isn’t totally unexpected since the bubbling relief felt in the market over the last few months is threatening to undo all the hard work the Fed has been doing by raising rates. If investors return to the punchbowl too soon, the Fed will have no choice but to raise rates even higher to break inflation. The Fed needs to keep a lid on the market’s optimism, and the last two sessions had the desired effect.

While I still count myself as one of the soft-landing optimists, I know better than to trade my opinion. As I wrote Tuesday night before the Fed’s policy statement:

Give the market a few minutes to process the news and be careful because the initial knee-jerk is often in the wrong direction, but after a handful of minutes, the market will no longer be able to hide its true intention and it will be a big move. Whether that is up or down is anyone’s guess, but as nimble traders, there is no need to guess. Follow the market’s lead and let the profits come to us.

Well, here we are down more than 4% from the Fed announcement. While my optimistic inclination was misplaced, my agnostic trading plan was spot on the money. No one likes being wrong, but a big pile of profits definitely cushions the ego blow. In fact, if I can make this much money being wrong, here’s to hoping I’m wrong a lot more often.

As for what comes next, shorting stocks is one of the hardest ways to make money because the windows of opportunity are so small and the inevitable bounce comes hard and fast.

Closing Thursday near the intraday lows means we can continue holding Wednesday’s short positions, but be sure to lower our trailing stops. By this point they should be even lower than our entry points, making this a very low-risk trade. But we’re not looking for low-risk, we are looking for profits and that means keeping a close eye on this one.

Maybe prices bounce Friday, but more likely the next bounce comes early next week. Lock in profits when it arrives and then get ready for the next trade.

As much as bears want to believe stocks are headed back to October’s lows, this will bounce long before then. Don’t get greedy and be sure to lock in worthwhile profits. Remember, we only make money when we cash in our winners.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.