It’s gonna get worse, but more important, when it will get better

By Jani Ziedins | End of Day Analysis

Thursday was another rough session for S&P 500 as the index shed an additional 1.3%.

So much for the post-Labor Day rebound. But this wasn’t a surprise for readers of this free blog. As I wrote Wednesday evening:

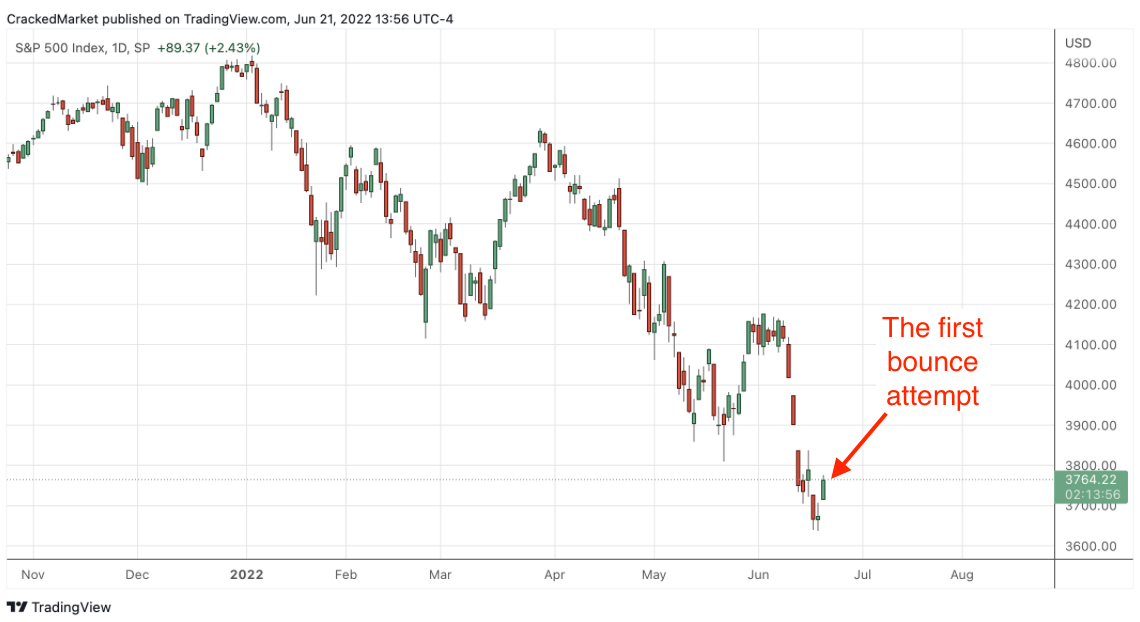

Bouncing 0.3% on the heels of -4.3% bloodbath is downright pathetic. Stocks rebound from oversold levels hard and fast. And since Wednesday’s bounce was neither hard nor fast, that tells us the market is not oversold yet…at this point, the wind is blowing in the other direction and momentum is clearly lower. Don’t relax because it is about to get worse.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

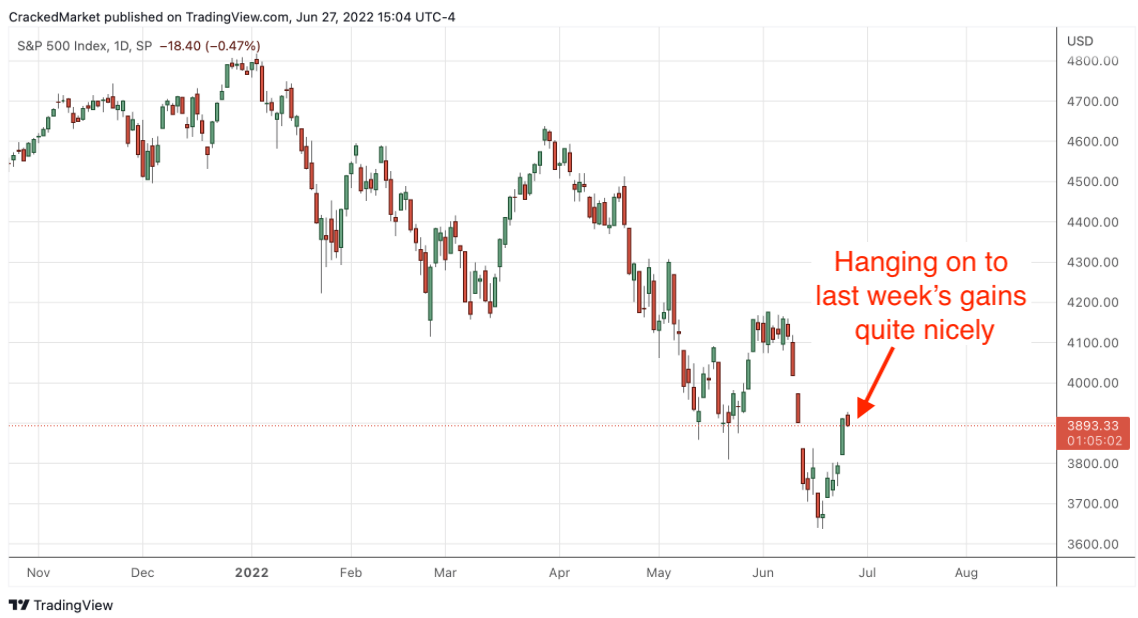

And as expected, the S&P 500 tested and violated 3,900 support Thursday. Unfortunately, dropping a handful of points under support doesn’t count as capitulation, meaning things need to get even worse before they can get better.

Now don’t get me wrong, I’m an optimist at heart and I’m looking for the next bounce, but we need a little more near-term pain before we break through to the other side. Maybe stocks fall hard Friday morning and that signals capitulation. Or maybe the selling doesn’t exhaust itself until Monday or later next week. But at this point, we still need to drive real fear through stock owners’ hearts before this will bottom and bounce. Until then, look out below.

Tuesday’s crash was shortable. We could continue holding the short through Wednesday’s pathetic bounce. And Thursday’s minor violation of 3,900 was only the warmup act, telling us to stick with the short trade into Friday.

What’s coming on Friday? More pain.

But the important thing to remember about short trades is they always end in a hard and fast bounce, so don’t get greedy. Just when this trade looks like it is unstoppable is when we need to pull the ripcord and lock in those short profits because holding a few hours too long will wipe out a big portion of our profits.

And when we bounce, be ready to grab that next wave higher because those first few hours will be very profitable. Maybe the bounce arrives Friday. Maybe it comes Monday or later next week. But it will be here very soon and we need to be ready to jump aboard as soon as the selling climaxes in a spectacular and obvious way.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.