Why I like boring markets and what’s up with $TSLA?

By Jani Ziedins | End of Day Analysis

Wednesday was another quiet session for the S&P 500 following last week’s 4k breakout.

While most traders are addicted to drama, boring is vastly underrated. Emotional markets produce big moves, unfortunately, most of the time the big action occurs in the wrong direction. On the other hand, boring markets make far smaller moves, but most of them line up in the positive direction. And lucky for bulls, we are in the middle of a very boring market.

Headlines remain benign and stocks continue rallying on “less bad than feared”. Until something changes, stick with what has been working. Hold for higher prices and keep lifting our trailing stops.

The index finished with a small gain but someone forgot to tell TSLA. The electric car maker lost 3% in an otherwise decent day for leading growth stocks.

While we don’t want to overreact to a single day of underperformance, we need to see TSLA lead this market higher, not lag behind it.

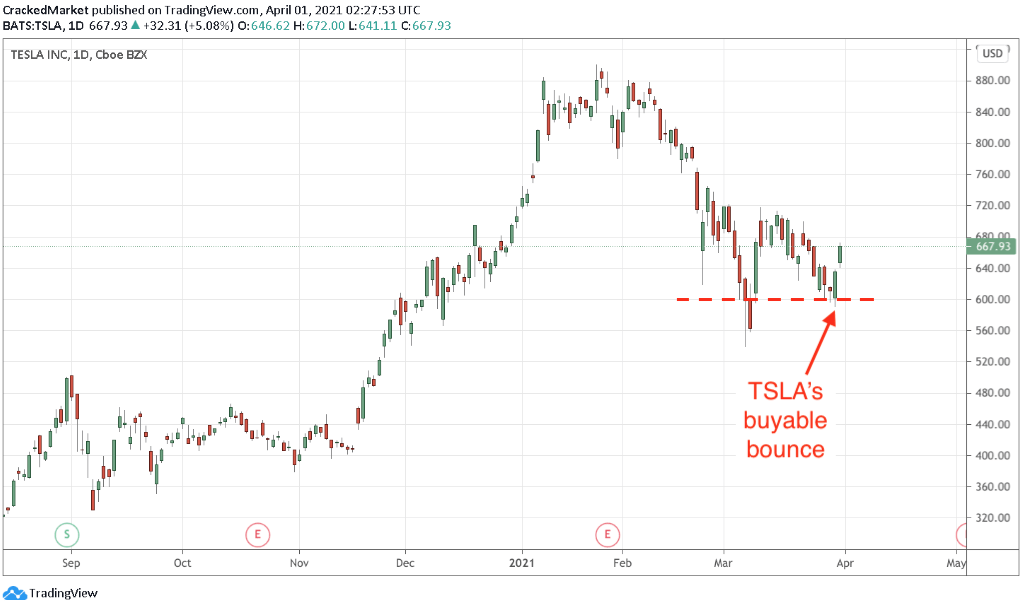

Last week’s nice bounce off of $600 support was buyable, but if this underperformance continues, we need to pull the plug and lock-in profits while we still have them. (And if this retreats under $600, that becomes an attractive short entry.)

I’m not giving up on this stock just yet, but I have it on a short leash.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.