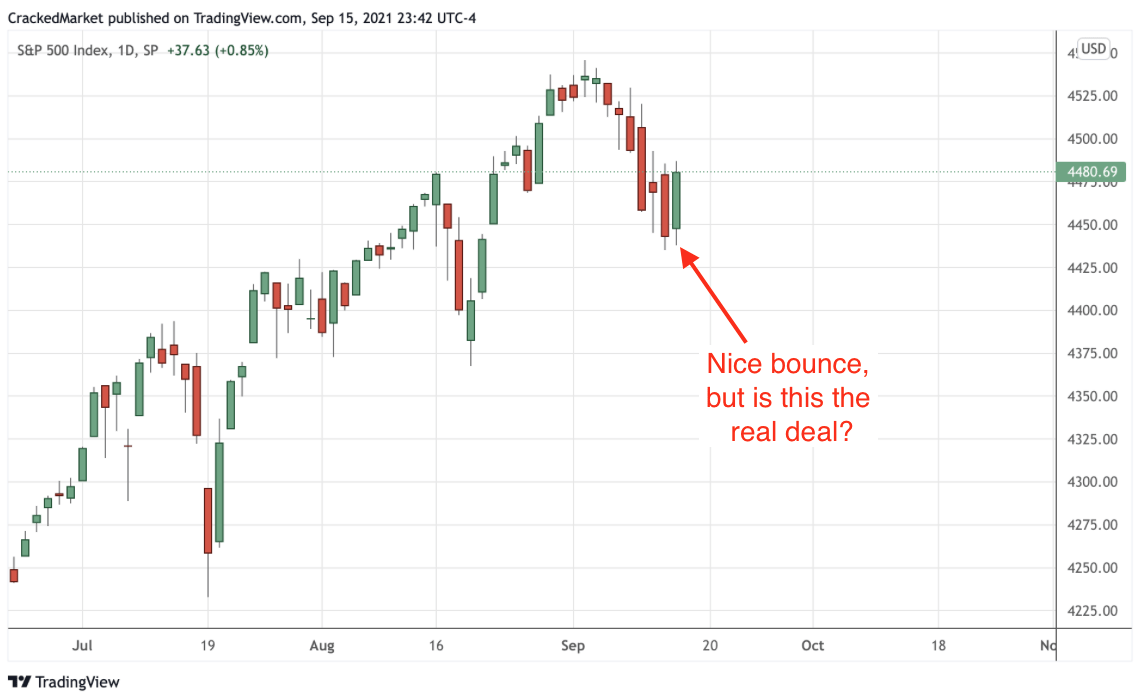

Did you buy the bounce? If not, why not?

By Jani Ziedins | End of Day Analysis

The S&P 500 surged for the fifth day in a row on Tuesday and finds itself less than half a percent from all-time highs.

Does anyone see a correction because I sure don’t?

None of the issues weighing on the market last month have been solved, but obviously, they don’t need to be solved for stocks to bounce back. The selloff was triggered by fear of the worst and when none of these problems spiraled out of control, stocks rallied in relief.

I will be the first to admit [last] Wednesday’s bounce wasn’t all that attractive and I was already suspicious of this market, so my gut told me to ignore the bounce. But I don’t trade my gut, I trade my trading plan and that told me to start with a small position Wednesday afternoon.

Well, it’s a good thing I listened to my trading plan because the index is now 3.5% above Wednesday’s close. Trade that with a 3x ETF and well….you get the idea.

I often remind readers the best trades are often the hardest to pull the trigger on. I didn’t want to buy last week and if I listened to my gut, I would have missed out on all of these nice and easy profits.

But rather than pat myself on my back, it is time to switch from offense to defense. I have nice profits and it would be criminal to let these escape. I moved my stops up to the mid 4,400s in anticipation of stalling at the old highs. But rather than pull the plug on a trade that is working, I’m willing to give this more time and wait to see what happens next. Break the old highs and I keep holding. Stall and retreat, I get out at my stops and wait for the next bounce.

As for anyone that missed last week’s bounce, well, it happens. Rather than force an ill-advised trade here, step back, admit you missed it, and wait for the next good trading opportunity. It will come along sooner than you think.

As for the next entry point, a break above the old highs is buyable with a stop just under this level. Start small, get in early, keep a nearby stop, and only add to a trade that is working. The odds of this breakout trade working are not great, but if you get into at the right time, the risks are very manageable and the potential reward is worth the effort.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.