The only way to trade this “too high” market

By Jani Ziedins | End of Day Analysis

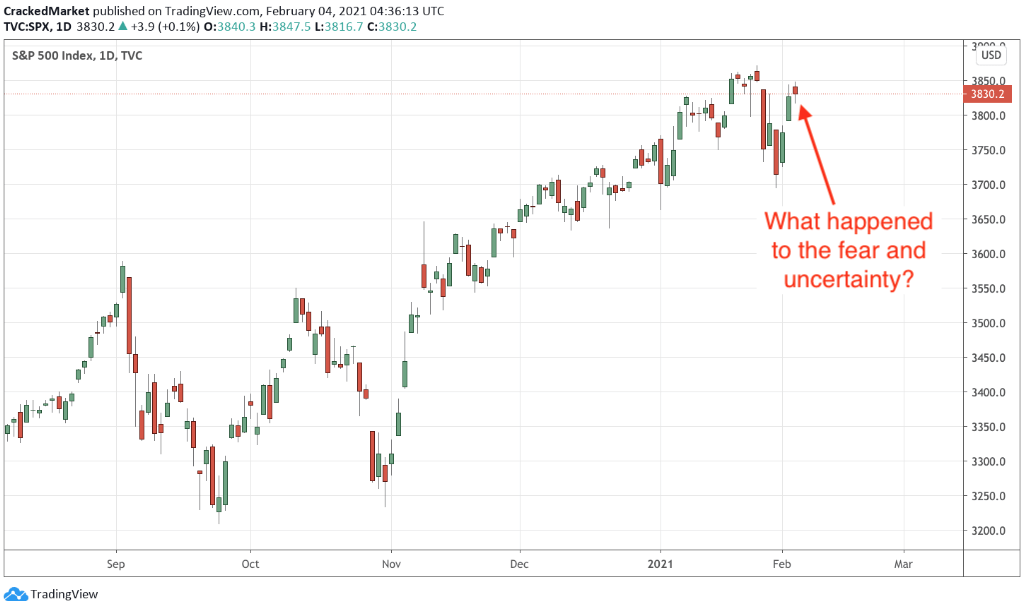

It was another good week for the S&P 500 as it added 1.2% and continues grinding its way into the record books.

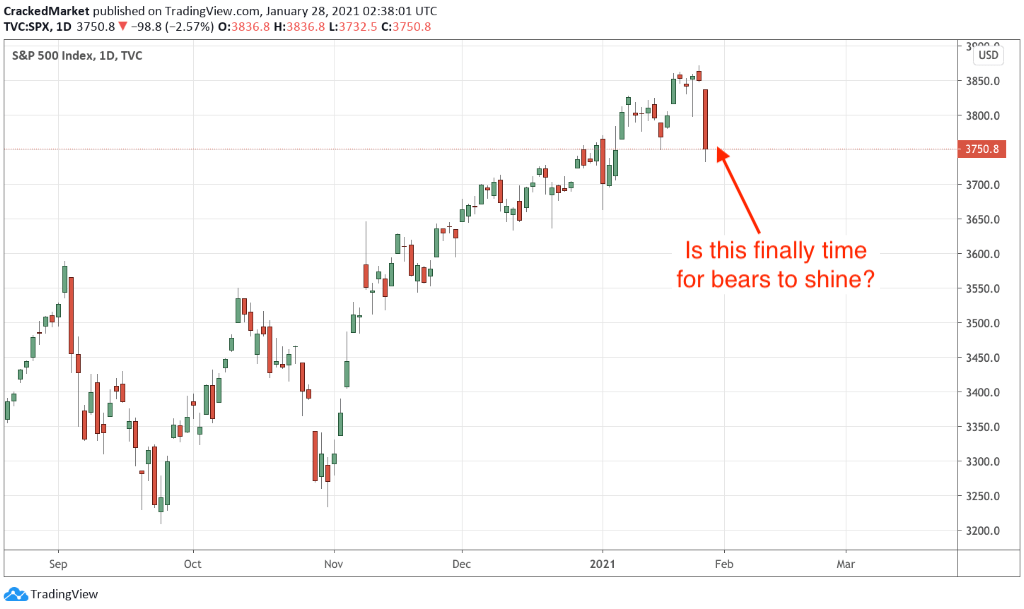

It’s only been two weeks, but the meme stock feeding frenzy is definitely over. GME retreated 89% from the highs and AMC is down 73%, with both stocks slipping another 20% this week.

It was spectacular while it lasted, but anyone with even the smallest amount of market sense knew this spectacular collapse was inevitable. The market loves symmetry and what races higher with breathtaking speed ends up crashing down just as quickly. No conspiracy needed.

As for the indexes, they are relieved the meme frenzy left as quickly as it came. The old rules still apply and conventional investors don’t need to worry about these bubbles infecting to the rest of the market. Those reassurances put the nearly year-long rally back on track and pushed the index back to record highs.

That said, most of the index’s strength is coming from beaten down, garbage stocks catching up as the economy starts rebounding from Covid. The FAANG stocks have been stuck in neutral lately, but this was expected.

The strongest stocks bounced early in the recovery and they have less room left to go. I don’t mind this underperformance as long as the FAANG stocks keep treading water. But for the entire market to start the next meaningful leg higher, we need the best-of-the-best companies to wake up and start leading the charge. Until then, expect further index gains to be slow and fitful.

If stock prices were overbought and vulnerable, we would have crashed by now. This market still wants to go higher and there is only one way to trade it. Keep holding for higher prices and lifting our trailing stops up.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.