ZM: Bargain or Bull Trap?

By Jani Ziedins | End of Day Analysis

It’s been a good couple of days for ZM. The stock bounced decisively off recent lows and gained 5.7% Tuesday and it added another 2.2% Wednesday. What’s not to like about that?

Well……

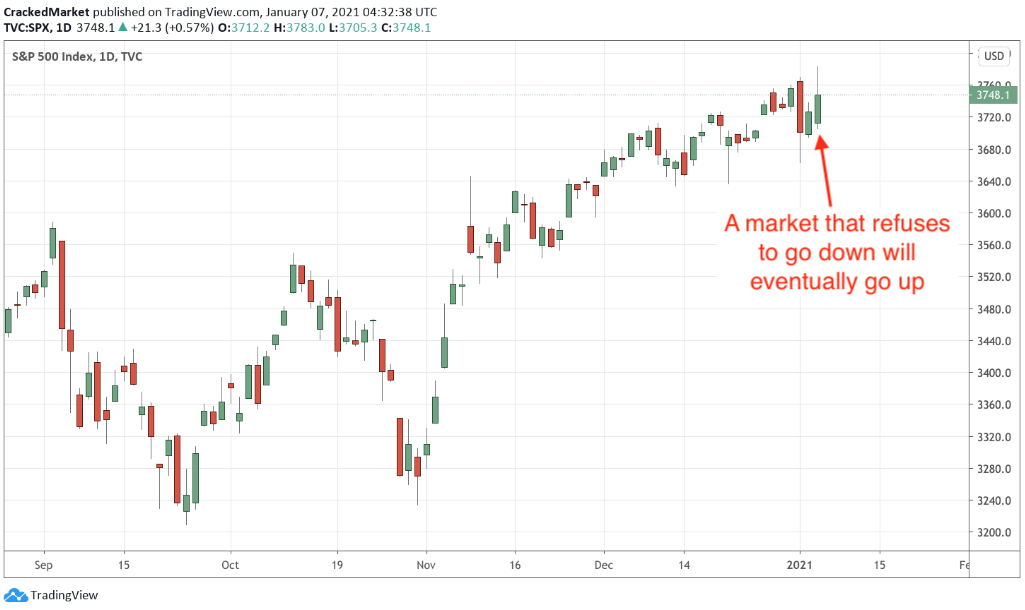

Every rebound starts by bouncing off of the lows and ZM has done a great job resisting another leg lower this month. I often say, “something that refuses to go down will eventually go up.” Unfortunately, that doesn’t apply to ZM here. In fact, this looks more like the mirror image, “something that hangs out near the lows long enough will eventually fall under them.”

Tuesday’s bounce was a good start, but Wednesday’s 2.2% gain was actually more bearish than bullish. That’s because the stock retreated from much higher levels earlier in the day. In the stock market, it’s now how you start, but how you finish that matters most. And in this case, rather than embrace the early rebound, regretful owners took the opportunity to sell these higher prices. Selling pressure every time the stock rallies tells us a large number of owners have given up and are looking for the best way to exit their positions. That’s never a good sign.

As far as the stock chart goes, even the last two days of gains cannot erase all the damage that’s been done. At the very least, the stock needs to get above $380 resistance and break above the larger downtrend. Until then, this remains a shockingly bad chart.

ZM will be a lot more interesting if it back above old support at $400. Until then, this is a no-touch (and a shorting opportunity for the most aggressive trader).

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.