How to make money when you’re wrong

By Jani Ziedins | End of Day Analysis

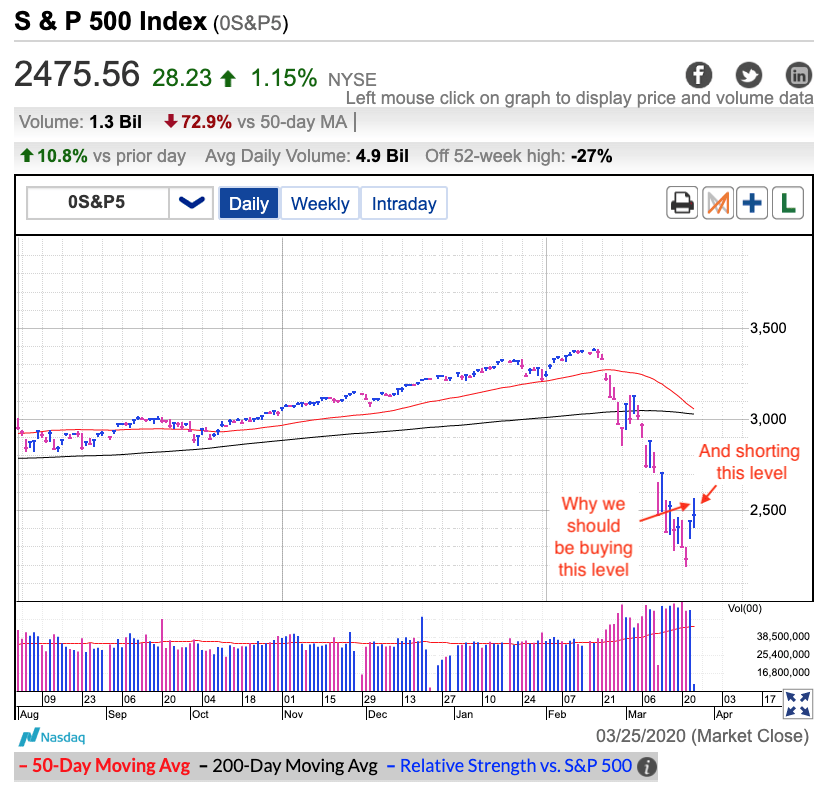

In Tuesday’s free after-hours post, I explained why I felt the market’s recent runup left us vulnerable to a near-term pullback. Those suspicions seemed confirmed by yesterday’s intraday selloff that erased all of the impressive opening gains. While I liked what I saw and in a normal market I would have held that short for multiple days, unfortunately, these are most definitely not normal times.

It has been my policy for a few weeks now to not hold positions overnight. These 2%, 3%, and even 5% opening gaps leap over any sensible stops we use to protect ourselves. Sometimes the gaps are higher, other times they are lower, and so far I haven’t figured out a reliable way of anticipating how the market is going to react to the overnight headlines. Rather than risk losing my profits the next morning, I take those profits in the afternoon and look for a new trade the next morning. While I normally don’t like day-trading, we trade the market we are given and this is the one we get.

But as unreliable as the open gaps have been, the market’s first move has been quite reliable and often signals a much larger intraday move. Most of the time that means buying the early move, hanging on, and taking profits in the afternoon.

While it’s been a good strategy, it doesn’t always work and that’s why we need a nearby stop to minimize the cost of any mistakes. And more than just that, the other thing I noticed lately is when I’m wrong, I tend to be really wrong. Rather than simply pull the plug and try again the next day, I pull the plug and switch directions. As much as it feels wrong to go against my gut, it gets a lot easier to tolerate when we see the profits pile up.

And that’s exactly what happened today. I started the day flat and the initial dip from the open got me in on the short side. This is the swoon I was looking for and everything was going according to plan. But by midmorning, the early slide bounced and overtook the opening levels. Rather than argue with the market or convince myself to give the trade a little more time to work, I pulled the plug. And more than just pull the plug, as I said, when I’m wrong, I tend to be really wrong, so I switched directions, went long, and held on.

While no one is getting rich from a 1% or 2% intraday move, do it enough times and the profits start to add up.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every day.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, have actionable analysis and a trading plan delivered to your inbox every day during market hours

Follow Jani on Twitter @crackedmarket

Tags: S&P 500 Nasdaq $SPY $SPX $QQQ $IWM

You must be logged in to post a comment.