What smart money is doing at these multi-month highs

By Jani Ziedins | End of Day Analysis

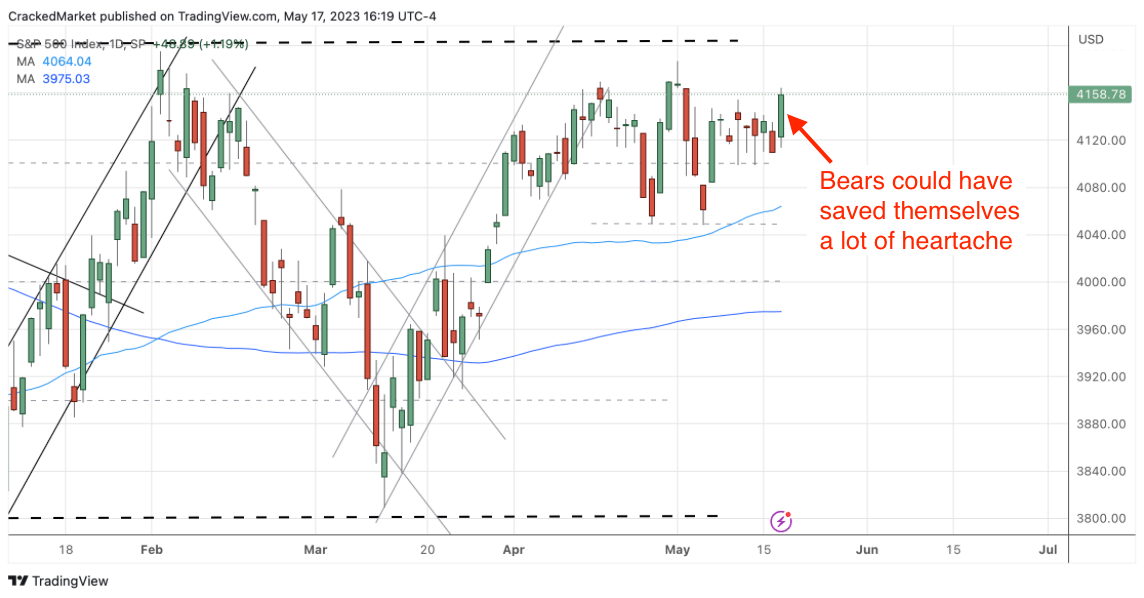

The S&P 500 added 1.5% Friday as it powered to ten-month highs.

May’s employment report showed the most robust hiring in four months as employers continue shrugging off persistent inflation and high interest rates.

This was one of those half-full/half-empty moments for the stock market and it was all half-full on Friday as investors embraced the economic resilience and shrugged off the prospect of future rate hikes.

Will the stock market’s indifference to inflation and interest rates last? Probably not. That’s why smart money is already locking in some profits at these multi-month highs.

Ignore both the bulls and bears. Anyone positioning for a big directional move in either direction is simply not paying attention. This is a choppy, sideways market with a slight upward bias. Money is made trading against these swings, not betting on their contuation. Until further notice, dips are buyable and rips are sellable. And just as important, take profits early and often because anyone holding a few days too long will watch their winners turn into losers.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

Bears were right for a few hours this week during our brief “sell the news” moment, but anyone that didn’t collect those profits were left holding a pile of losses a day later.

And the same will apply to bulls pressing their bets at multi-month highs. We take profits when we have them because if we don’t, the market will steal them back a day or two later.

I still like this market and the slow grind higher will continue, but anyone pressing their luck near 4,300 hasn’t been paying attention. Lock in some very worthwhile profits (7.5% in a 3x ETF over the last two sessions) and then get ready for the next trade.

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, help me out by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.