Is the rally back on?

By Jani Ziedins | End of Day Analysis

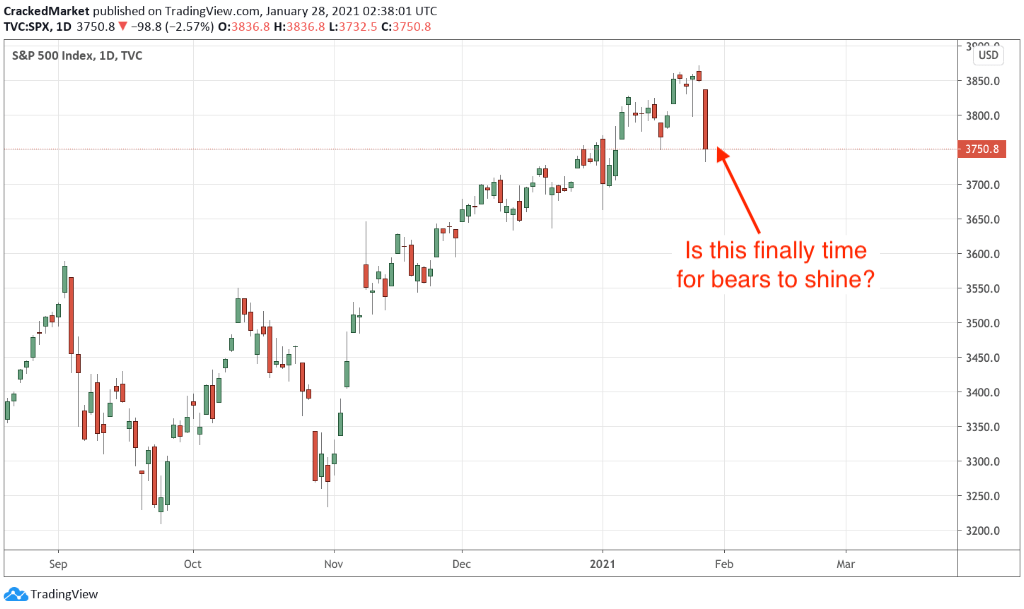

The S&P 500 bounced back Monday, recovering a respectable chunk of last week’s 3.3% tumble.

There were not any clear or obvious economic headlines driving last week’s selling and the same applied to today’s bounce. This was little more than a fleeting swing in sentiment as investors digested last week’s frenzied buying of a handful of beaten-down stocks.

Up to this point, investors have been ignoring any and all bad news and chances are good this latest wobble won’t turn out any different. But last week’s buying frenzy of a handful of garbage stocks gave mainstream investors pause. While they were previously okay with moderately stretched valuations in respectable names, they were not ready for the absurd silliness that was occurring in nearly bankrupt companies.

Most likely, this index pullback won’t end any differently than all of the other pullbacks that came before it. This dip went a little further than most of the others, but this bull market is far from broken. If prices continue firming up this week, last week’s dip will actually turn out to be a healthy development. Every sustained move higher needs a few step-backs along the way.

As for trading this chop, sometimes indexes bounce within hours. Other times the selling stretches across several days. When accounting for the market’s mood, it is hard to know exactly how much it will over or underreact to each situation. That is why our trading plan must account for all possibilities.

Sometimes markets are easy to trade and the indexes drift higher without ever seriously threatening our stops. Other times it shakes us out several times before making its next move.

I still believe this market is headed higher over the medium term, but it might squeeze me out at my stops one or two more times before it finally happens. Or maybe we shoot back to the highs without looking back. Either way, my trading plan is ready.

If this keeps going up, I buy. If the pullback resumes, I get out at my stops and prepare to buy the next bounce. It doesn’t get any more complicated than that.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.