What Tuesday’s small decline tells us about what’s coming next

By Jani Ziedins | End of Day Analysis

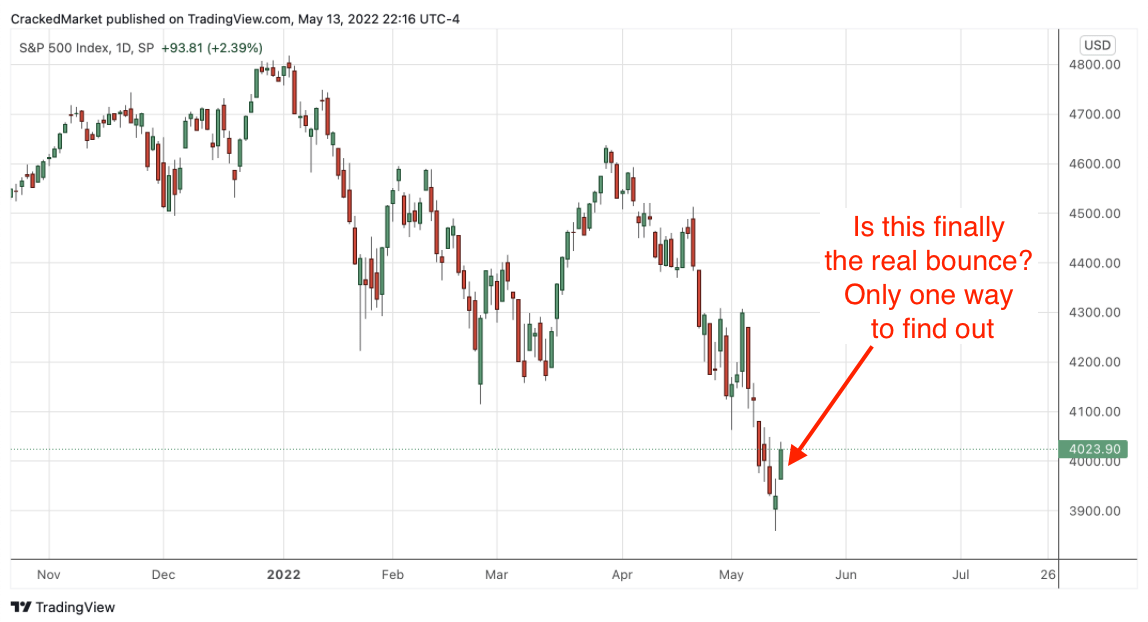

The S&P 500 slipped 0.4% Tuesday.

While a small loss usually isn’t something worth worrying about, these are not usual times. The lack of a meaningful bounce following Monday’s nearly 4% crash suggests the selling hasn’t capitulated yet and lower prices are still ahead of us.

I typically have a bullish bias when it comes to the market because stocks spend far more time going up than down. That means I’m always on the lookout for a bounce to buy, but Tuesday’s price action didn’t check my boxes.

As I often write, the market loves symmetry and this crash will almost certainly capitulate in a “V” bottom. Unfortunately, Tuesday’s modest slip lower doesn’t look anything like the start of a “V” bottom.

While this latest tumble was largely spurred by expectations shifting to a 0.75% Fed rate hike this week, this could very easily turn into a “sell the rumor, buy the news” event. This latest wave of selling priced in most, if not all of the widely expected rate hike, so when the news becomes official Wednesday afternoon, there might not be much selling left to do. And when a large wave of follow-on selling fails to materialize, we often see prices rally in relief that things weren’t worse.

The most likely scenario is the index reflexively crashes immediately following the Fed’s announcement of a 0.75% rate hike, but not long after, the selling capitulates and prices bounce, giving us that oh-so-beautiful “V” bottom.

And of course, another real possibility is the Fed is the one that capitulates and sticks to its previously telegraphed 0.5% move. That would also trigger a nice pop in the market. (Or counterintuitively, the market freaks out and stocks crash because investors start fearing the Fed lacks the courage to combat inflation.)

Will any of these things happen Wednesday afternoon? Only time will tell, but they are definitely scenarios we need to incorporate into our trading plan. If we can’t map out our responses ahead of time, how in the world are we going to do it in the heat of battle?

While we will likely see further selling before reaching the capitulation bottom, once that bounce takes hold, shorts need to get out of the way and everyone else needs to grab ahold because the move will be fast and hard. Maybe the rebound stalls at 4k resistance, but a 300-point rally in 3x ETF is enough to put a pile of cash in your trading account. You like cash, right?

Sign up for my FREE email alerts so you don’t miss the market’s next big move

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.