Tales of a stubborn bull market and a warning for $GME owners

By Jani Ziedins | End of Day Analysis

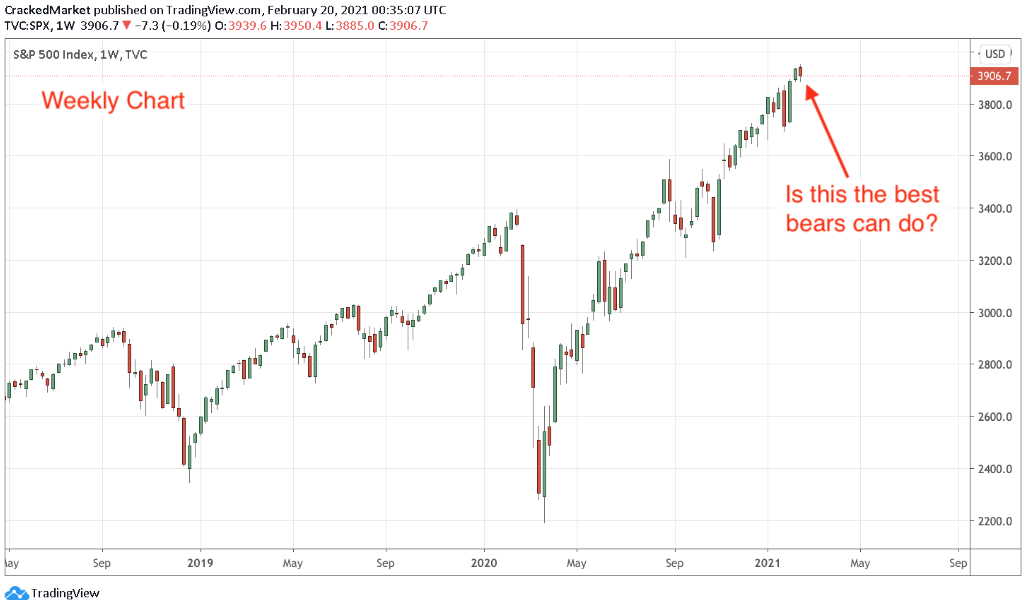

The S&P 500 lost 0.8% Tuesday in the second-largest give-back over the last few weeks. Yet even when combined with last week’s -1.5% down day, the index remains within 1.6% of its all-time closing high. Hardly bearish material.

That said, you have to give the bears credit for their persistence. But so far they have been unable to crack this resilient bull market. No matter what is thrown at this rally, it just keeps shrugging off the bad news. While the cynics have been wrong 100 times up to this point, they insist this time they are finally right. Could they be right? Sure. But will they be right? No, probably not.

Successful trading is a game of probabilities and right now odds favor a continuation. This is a stubbornly resilient market and rather than fight the stubborn strength, we should be going along for the ride.

I’d love it if this market cracked wide open and panicked sellers started giving away stocks at huge discounts. Unfortunately, I don’t see that happening. We need to get cautious if Tuesday’s dip continues under Friday’s intraday lows. But until then, stick with what has been working, which is holding for higher prices.

GME reported earnings after the close and they missed pretty big on both the top and bottom lines. That didn’t stop after-hours traders from bidding up the stock right after the earnings release. Unfortunately, that initial strength was short-lived and the stock ultimately closed down 15% by the end of the after-hours session.

I’ve been skeptical of the sustainability of this latest “echo” and it seems the bounce’s momentum is quickly petering out. As I’ve been telling Premium subscribers for over a week, once this thing falls under $200, it ain’t coming back. There are only so many fools willing to pay $200 for a $20 stock and it looks like we finally ran out of them.

This was a momentum trade and now that the momentum’s gone, there is no reason to own this. Hopefully, regretful buyers from the first runup were able to get their money back during this impressive echo. But if they didn’t, they have no one to blame but themselves.

If you find these posts useful, please return the favor by liking and sharing them!

Sign up for FREE Email Alerts to get profitable insights like these delivered to your inbox every evening.

What’s a good trade worth to you?

How about avoiding a loss?

For less than $1/day, receive actionable analysis and a trading plan every day during market hours

Follow Jani on Twitter @crackedmarket

You must be logged in to post a comment.